Buying HDB after selling a private property

Buying HDB after selling private property is a way for some elderly owners in Singapore to consider when closer to retirement age.

As you grow older, you might not actually need a condo with facilities such as a swimming pool or a gym or tennis courts. You might instead prefer a simple small place to stay and a smaller area to clean up.

In addition, you might want to monetise your profitable private property to generate some retirement funds. In many cases, due to the gap between a private property and a HDB flat, the funds might be quite substantial.

Finally, in terms of financial support from the government, very frequently HDB owners (especially the smaller size HDB flats owners) can get very good support in terms of GST rebates and service and conservancy charges rebate and even Singapore Power utilities rebates. Every cent counts in retirement age.

For elderly HDB owners, the Singapore government has several schemes to help the older owners. These schemes includes the Silver Housing Bonus, the Lease Buyback Scheme, the sale of 2 Room Flexi flats with very short leases etc. I will do an article on these schemes in the future.

For private owners, they can either rent out one or two rooms, they can also rent out the whole private property unit and then move to stay with their children or finally buying a HDB flat and then sell the private property.

This last method is the subject of this article.

Can you be buying HDB after selling private property

That’s the number one question we always face. This is because for many people, HDB remains a “special subsidised priority scheme” for the Singapore citizens. After all, you have purchase a private property and can you really “come back” to the HDB world ? 🙂

The answer is YES, you can buy HDB flat after selling private property.

However, having said that, there are many conditions that can create several practical issues. Here are a couple of things to consider when buying a HDB flat immediately after selling your private property.

The general rule is, of course, you need to be “selling your Private Property within 6 months after buying the HDB flat”. That is the basic rule as you are not allowed to own a private property AFTER buying a HDB flat (on the other opposite end, you are allowed to buy a private property after buying a HDB flat and completing the 5 years minimum occupation period).

(Latest from 30th September 2022) : it is no longer possible to buy a HDB resale AFTER selling your private property unless you are 55 years and above AND you are willing to buy a 4 room flat and below. Else for the rest of us, you need to sell first and then wait 15 months before you can buy a HDB resale flat. See this article on 15 months wait for more details. Or contact me for more information.

What are some things to watch out for

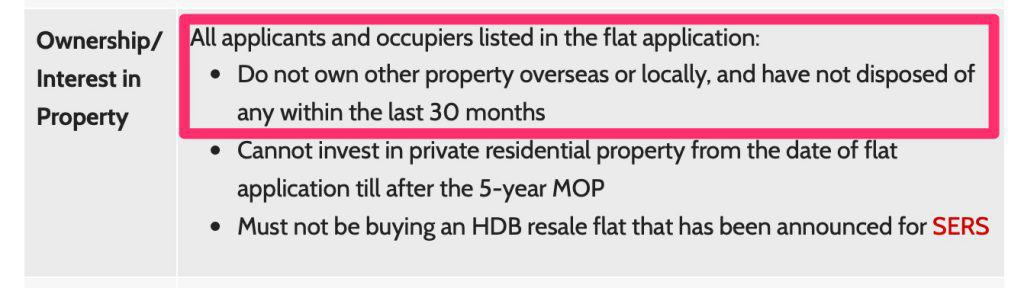

Point 1 : You cannot buy a BTO flat until 30 months after selling your private property

As you just sold your private property, you cannot buy a BTO flat till 30 months AFTER you sold your private property. Hence you will need to be be buying a HDB resale flat in the open market (but now after 30 Sep 2022, in some cases, 15 months AFTER you sold your private property).

BTO flats (ie completely new subsidised HDB flats) are not available to you for 30 months after selling your private property.

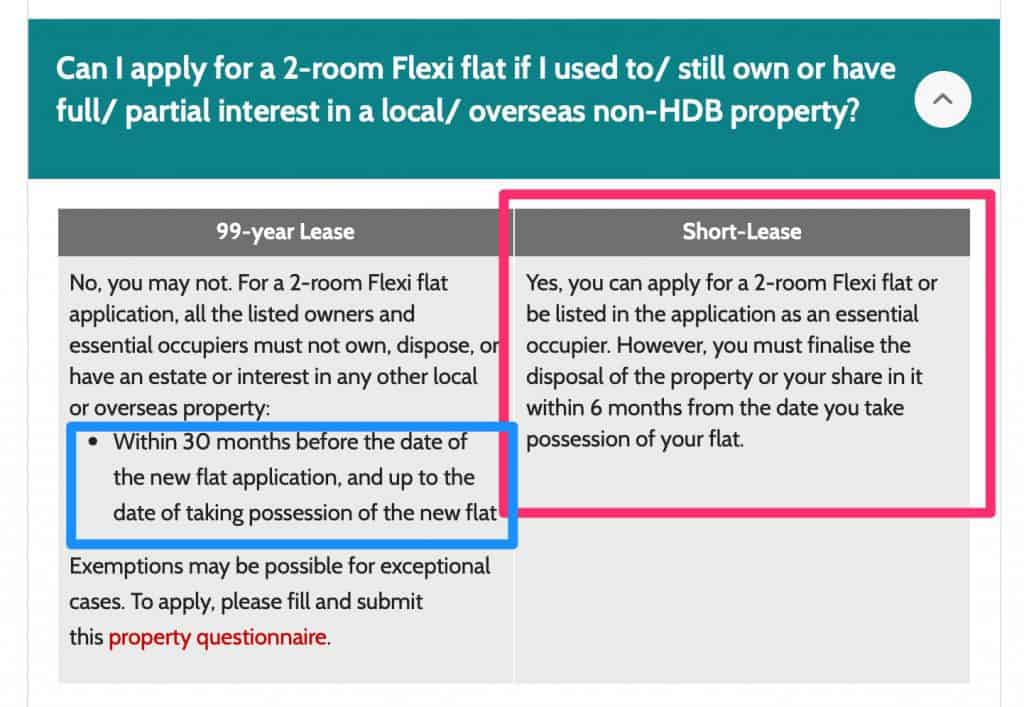

Except for one possible scenario where you are allowed to be buying HDB BTO after selling private property. An elderly couple or a single elder (more than 55 years old) can buy a 2 room flex BTO flat but this 2 room flex home must be purchased with short term lease. The short term lease must last the youngest owner to the age of 95 years old.

This is seen in the 2 room flexi flat information page in HDB web site.

This is the unique opportunity for an elderly couple to buy a new HDB flat after selling the private property. I believe the government did this to encourage elderly couples or single to consider a short lease flat (at an affordable price) after “using up their BTO chances”. Or selling a private property.

However, there is one practical issue. The BTO flat will need to be built 😉 That would take a few years. That would not be a practical solution to someone who just sold their place.

In that case, it might be necessary to look at Balance of Sale of Flats for immediate booking and then occupation.

If this works out, this is the best resizing to public housing.

Point 2 : You don’t have any HDB housing grants

As you just sold your private property, you will now not have access to any HDB housing grants (except perhaps for the proximity grant). This is even if you have not got any housing grants in your life before.

The primary condition for any HDB Housing Grant (family grant, singles grant, enhanced housing grant) is not just the various income ceilings but also the fact that you must NOT have sold any private property within the 30 months of the resale purchase.

It is clearly written in the terms and conditions on the CPF housing grant page.

Point 3 : You need to plan your finances carefully

As you cannot qualify for a HDB loan (again because you just sold your private property), you will need to be getting a bank loan. If your age is at 55 years old or more, this might be an issue as the limit on bank loans are 65 years old. It will be a very short tenure. Monthly payments will be high probably.

If you have an outstanding loan on your private property, buying your HDB flat also meant that your Loan to Value (LTV) are going to be affected. You will not qualify for a full 75% loan. You will need to have a lot of cash and CPF for the initial payment.

So the very prudent thing is to clear off the private property and its loan BEFORE proceeding to purchase a HDB private loan. This is why many financial experts always advise that all home loans are cleared by 55 years old.

Point 4 : You need to plan your timeline carefully

You should also be planning your transactional timeline carefully such that you will have a place to stay after selling your private property and then purchasing a HDB resale flat. A good property agent will be able to help you in planning your private property sale and negotiating with the HDB seller for your benefit.

All the above are applicable within the 30 months after selling your private property.

30 Months after Selling Your Private Property

30 months after selling your private property, you can now do the 4 things above.

It is like “life has been reset” for the seller of the private property.

However, to do the following, it means you basically have done NOTHING (e.g. stay with your children, rent a place to stay etc) for 30 months of trying to be “buying hdb after selling private property”.

Can you really do that for 2 and half years ?

If you can, and you meet the eligibility criteria, then you are going to profit quite a little in terms of selling your private property and ending up with a new subsidised flat.

(1) You can now buy a BTO (subject to meeting other criteria like income ceiling and first timer vs second timer etc). Because of your age, you might want to consider buying a 2 room flex BTO with shortened lease.

This will be the cheapest way of buying a BTO. However, unless the BTO is ready, it is yet another 2-3 years wait for the BTO to be ready !

(2) You can now buy an Executive Condominium (subject to meeting other criteria like income ceiling etc)

(3) You can now qualify for CPF Housing Grants (subject to meeting other criteria like income ceiling)

(4) You can now quality for HDB HLE Loan (subject to meeting other criteria like income ceiling)

Conclusion for buying hdb after selling private property

As you can see, it is not a really simple solution of just buying HDB after selling private property. It sounds simple on paper but not the same when in practical terms.

The clearest path to doing so would be a fully paid private property which is sold for positive profit and good cash proceeds. Using these cash proceeds (and a good timeline planning), the elders can buy a small HDB resale flat for retirement and close proximity to facilities and their children’s place.

And if you are buying a HDB resale flat after selling your condo (and waiting out the 15 months), do read my article on why you should appoint an agent for buying a resale flat to help you. After all, you do have cash from your condo sale too 😄

Before You Go...

Do subscribe to my newsletter or follow me on my social media pages ;)

Member discussion