In 5 years time, only $60,000 of HDB housing grants can be used

When you purchase a HDB resale flat, you can opt to obtain the HDB housing grants that the Singapore government will provide for you. This is subject to a few conditions including income limit of $14,000 (per couple as at Sep 2019).

This helps to reduce the amount of monies that a young couple need to buy their first BTO or resale flat. This really goes a long way in helping them to obtain their first flat. Which is very useful for them to start a family.

When the HDB Enhanced Housing Grant (EHG) was announced on 11th Sep 2019, there was a very small footnote that might not have gathered enough attention from the press and the public.

But this small footnote would be important in the future. To be exact, when the first set of flats that were purchased with HDB Housing Grants that would be sold from 12th Sep 2024, this little footnote will seriously affect them !!!

What is this $60,000 limit on HDB Housing Grants going forward

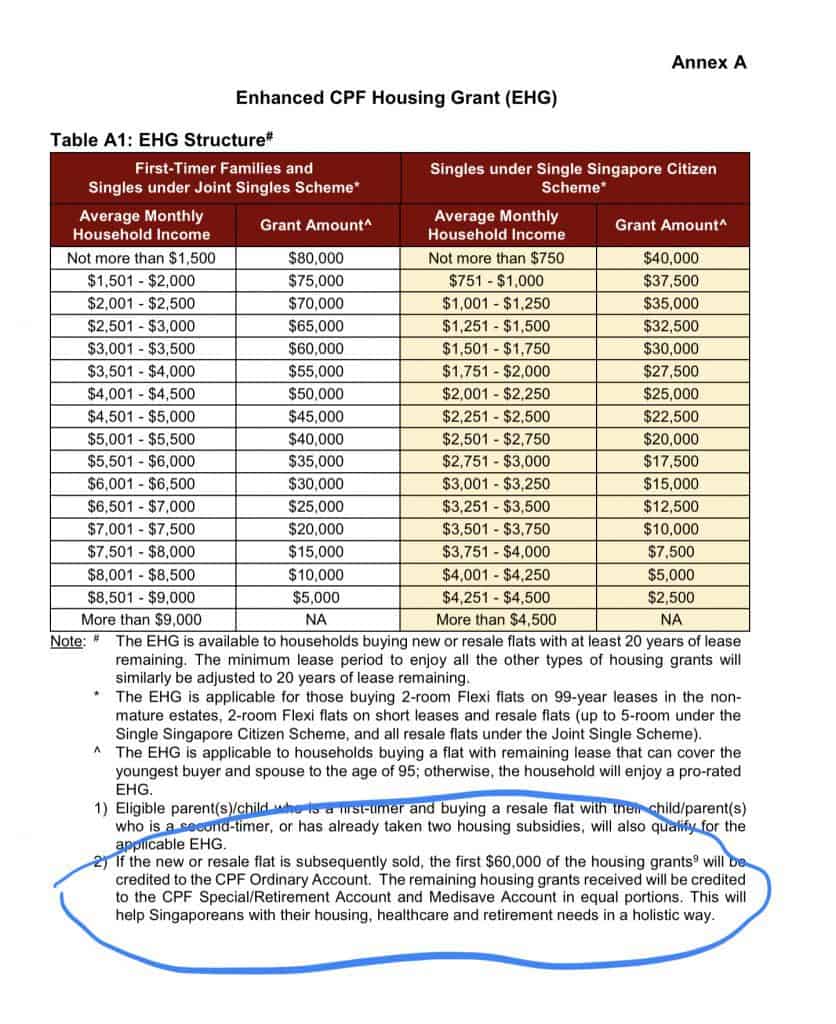

What is this footnote then ? Let’s look at the Annex A of the press release.

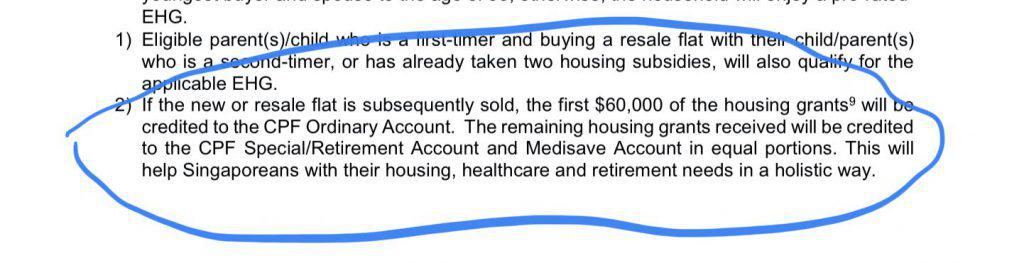

Let’s zoom in to the circled part:

The footnote stated :

If the new or resale flat is subsequently sold, the first $60,000 of the housing grants will be credited to the CPF Ordinary Account. The remaining housing grants received will be credited to the CPF Special/Retirement Account and Medisave Account in equal portions. This will help Singaporeans with their housing, healthcare and retirement needs in a holistic way.

What this means is that…. only $60,000 of the housing grants that were originally given (and now being refunded upon the sale of the flat) would be going back to CPF Ordinary Account. The rest will go to CPF Special/Retirement Account and Medisave Account. Note that as only balances in the Ordinary Account can be used for the purchase of properties, this effectively means that only $60,000 worth of the refunded housing grants can be used for the next purchase.

It is important to note that it is only the housing grants affected by the change. Any other refunds (e.g. your own CPF refunds due to the normal payment of the loans or your downpayment from your original CPF balance) are not affected.

In other words, what the government gives you, you cannot use all of them again for the next purchase. Only $60,000. That’s all. Give you a chicken wing and you cannot get a chicken, okay 🙂

To understand why this is important, let’s understand what happens today.

When you sell your HDB flat today, your friendly housing agent will be calculating your sales proceeds from the sale of the HDB. As part of the calculation, a portion of the sales proceed will be “refunded” to the CPF account. This refunds will include the original downpayment from CPF, your use of CPF for stamp duties and legal fees and the monthly loan payments you are making using CPF. Basically everything you use from CPF, you must pay back to CPF (upon your sale) together with the accrued interest.

Owe Money. Pay Money.

This portion is shown clearly in the CPF statement. You can then use the whole refunded amount for the next purchase.

What does it got to do with HDB housing grants

A lot. When you obtained the HDB housing grants from the government, that sum of monies is firstly deposited into your CPF account to help you pay for the flat (and by the way, the accrued interest starting counting from that moment onwards). That means, it is like Fairy Godmother has suddenly just deposited a large sum of money to your bank.

It is really that way. The government literally dropped a sum of money into your CPF account. So let’s say the owners got $120,000 worth of CPF grants. That means $120,000 is given to the owners’ CPF accounts.

Five years later, when Minimum Occupation Period (MOP) is over and the owners decided to sell the flat, the CPF statement may show total CPF to be refunded as $250,000.

This breakdown of $250,000 might be:

(1) $50,000 CPF downpayment

(2) $120,000 CPF grants

(3) $10,000 stamp duty and legal fees

(4) $70,000 housing loans payment

And maybe accrued interest of $30,000.

So total refunds back to CPF (from the sale of the HDB flat) will be $280,000.

That means, this whole $280,000 can be used for the purchase of the next flat. No limit. It is your money. You can use it whatever way you want including the purchase of the next property.

In fact, you can even withdraw it at age 55. That’s why some people would suggest getting a HDB flat to take advantage of the HDB housing grants at age of 49 and then just selling it at age 54. But that is a different topic from this one.

So what happens now from Sep 2024 (5 years from 2019).

HDB Housing Grants given in Sep 2019

Let’s say on 12th Sep 2019, a couple wants to buy a HDB flat and based on the income, managed to get the full grants available.

This will be a total of $160,000 worth of grants (in reality, it is highly unlikely someone gets that much).

(1) CPF Housing Grant : $50,000

(2) Enhanced Housing Grant : $80,000

(3) Proximity Housing Grant : $30,000

On 11th Sep 2024, when the same couple wants to calculate the sales proceed for this resale flat, the funds available to them to purchase the next flat is limited to $60,000. The rest of the grants ($100,000 + accrued interest) will go to the Special Account and Medisave account for retirement purposes.

That means, what used to be $160,000 + accrued interest, is now no longer available for the purchase of next flat. This is now just $60,000. That is a lot of reduction of $100,000 !!

At this point, I don’t feel that enough information are given or available on this change. Perhaps at a later stage, closer to 2024, more information will be given. But it is an important point to note for now.

Many questions to be asked of HDB for this change

(1) In the footnote, it is further mentioned that the $60,000 is “comprising the Proximity Housing Grant disbursed on or after 24 Aug 2015 and the EHG”. Why 24th Aug 2015 ? Was this change already part of the Proximity Housing Grant introduced in August 2015 ? I am not aware of that. Is the $20,000 or $30,000 worth of PHG subjected to this rule TODAY ?

(2) What will happen to the accrued interest on the EHG (e.g. let’s say the EHG is $60,000 and accrued interest on this EHG is $10,000 ? Would the $10,000 also go to Ordinary account (and hence available for the next purchase) ? Or it is only $60,000 going to Ordinary account and the $10,000 going to the retirement and medical accounts ? Is that fair ?

(3) How do agents (and house owners) know the breakdown between CPF Housing Grant, Enhanced Housing Grant and Proximity Housing Grants as today, it is not separated clearly.

So much questions. Would couples be surprised by this ? Would agents be knowledgeable about this ? I would look forward to 2024 to find out 🙂

The good thing is, of course, that this only affects flats in 2024. A long time away.

Hopefully we get more information as time comes closer. And hopefully HDB will provide more information closer to time too.

We shall see.

Member discussion