Foreigners and ABSD in Singapore

“All foreigners who buy properties in Singapore has to pay 20% Additional Buyers’ Stamp Duties”. True or false ? The topic of foreigners ABSD Singapore is really confusing and can be a very important knowledge in the real estate agents’ skill set to help foreigners to buy properties in Singapore. And like it or not, foreigners are buying lots of properties in Singapore.

And the above statement is false.

In my last blog post, we talked about what type of residential properties can foreigners buy in Singapore. But we did not talk about the financial impact of buying such properties. Specifically the impact of ABSD in the purchase of these properties.

(This article has been updated with figures from Dec 16 2021 ABSD Changes. See also this article. In April 2023, a new round of ABSD changes has been announced too. Read about that here)

Stamp Duties for a Foreigner buying a Property

Generally, any foreigners who buy a property in Singapore are subjected to two stamp duties.

Stamp Duty 1 : Buyers’ Stamp Duty (BSD). This one every one has to pay. Singaporeans, Singapore Permanent Residents and Foreigners. Everyone. Every single person and entity. The exact calculation is not the concern here. Read about it on 1000 web sites or IRAS web site. For me, as a quick calculation, I always say “take it as 4%”.

Stamp Duty 2 : Additional Buyers’ Stamp Duty (ABSD). Ah.. the dreaded ABSD. The killer measure to reduce properties prices from raising. The one true killer to stop a foreigner from buying a property in Singapore.

General Principle : The amount for a foreigner to pay ?

ABSD for a Foreigner : 20% 30%

Except for the following cases :

Singapore Permanent Residents

Now, if we consider a Singapore PR (Permanent Resident) as a foreigner in Singapore, then they do have a special chart for them in terms of ABSD. Check out my blog post on ABSD for Singapore Permanent Residents.

For Singapore PRs,

First Property is 5%

Second Property is 15% 25% 30%

Third Property or more is also 15% 30% 35%

So if you are a Singapore PRs, your first property ABSD is 5%.

Nationals of United States of America

Oh. The great US of A. The superpower of the world.

The nationals (ie. citizens) of USA, through something special called Free Trade Agreements (FTAs) signed between Singapore and the US of A, entitled them to a specific treatment.

Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

United States of America citizens are entitled to be treated the same as Singapore citizens…. see this article from Straits Times on this.

What is meant by the “Same Stamp Duty Treatment as Singapore Citizens” ?

Singapore Citizens pay the following ABSD rates:

First Property : Zero ABSD

Second Property : 12% 17% 20%

Third Property and beyond : 15% 25% 30%

So here you go.. the American citizen who buys a property in Singapore, pays also the same as a Singapore citizen.. which means..

The American citizen also pay….

0% ABSD !!!

Celebration time ! Yes !!! Huge Savings !!!

The negotiators for Singapore FTA with America have done a great job….

What about a Green Card Holder

And no, a “Green Card holder” does not count 🙂

A green card allows a non-U.S. citizen to gain permanent residence in the United States. Many people from outside the United States want a green card because it would allow them to live and work (lawfully) anywhere in the United States and qualify for U.S. citizenship after three or five years.The Green Card, Explained “https://www.boundless.com/immigration-resources/the-green-card-explained/”

Green Card Holders are not USA Citizens. So they are not entitled to this special privilege for US of A Citizens. Too bad. Wait a few more years to get US citizenship okie :)

Nationals and PRs of Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

Now the FTAs treatment gets even more interesting and bigger in scope.

F or citizens AND Permanent Residents of four other European countries, you get the same treatment as Singaporeans.

These four countries are Iceland, Liechtenstein, Norway or Switzerland.

Okay. They are not big countries and generally they don’t buy properties in Singapore. Too expensive in Singapore and who has a nicer view ?

Switzerland or Singapore……………

If someone from these four countries (Citizens or even Permanent Residents in this case), then yes they get 0% ABSD for first property, 12% 17% 20% for second property and 15% 25% 30% for third property.

Cool huh.

The Rest of the World pays 20% 30% 60% ABSD

Yes I am speaking about Chinese from Mainland China, Malaysians, Indonesians, Indians, Australians, Koreans etc

And Hong Kong SAR too.. who, in recent months, have been moving funds to Singapore and buying properties…

Good news……

You all pay 20% 30% 60% ABSD……….

This is a huge cost but then Singapore gives a politically stable environment, clean government, clear rules and regulations, and a business friendly country with great education system. What is 20% 30% 60% ABSD 🙂 (Actually, ouch)...

What if I am an American citizen but a Singapore Permanent Resident too

Oh.. you are so lucky. You are a citizen of the country who has a FTA agreement with Singapore and yet you are a permanent resident in Singapore, staying here for a long time and enjoying the benefits of Singapore.

So do you pay 0% ABSD (because you are an American)

OR

do you pay 5% ABSD (because you are a Singapore PR).

In this case, country takes precedence over residency.

So you are an American for the purpose of purchasing your first property in Singapore.

So you pay 0% ABSD.

Happy !!! 🙂

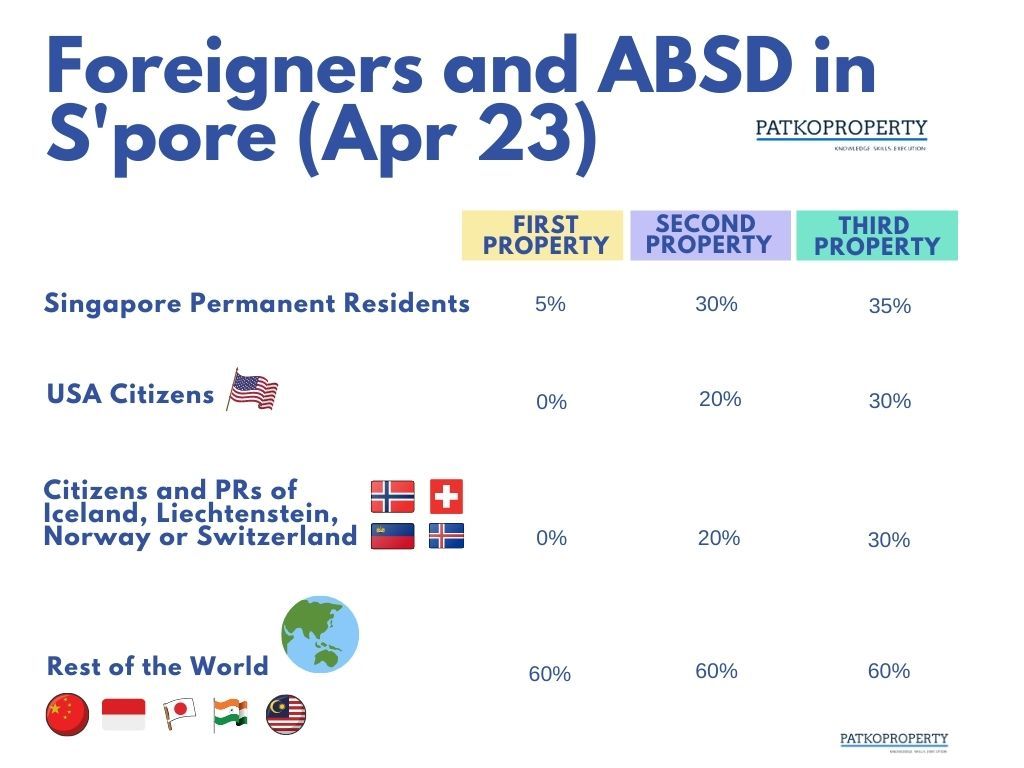

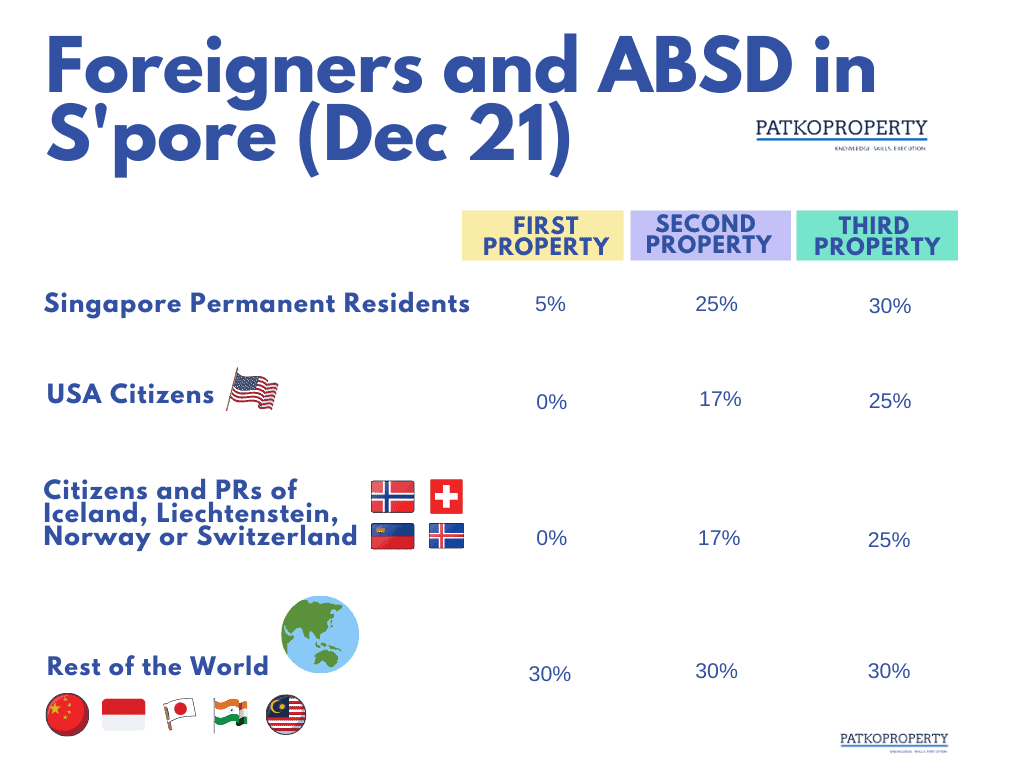

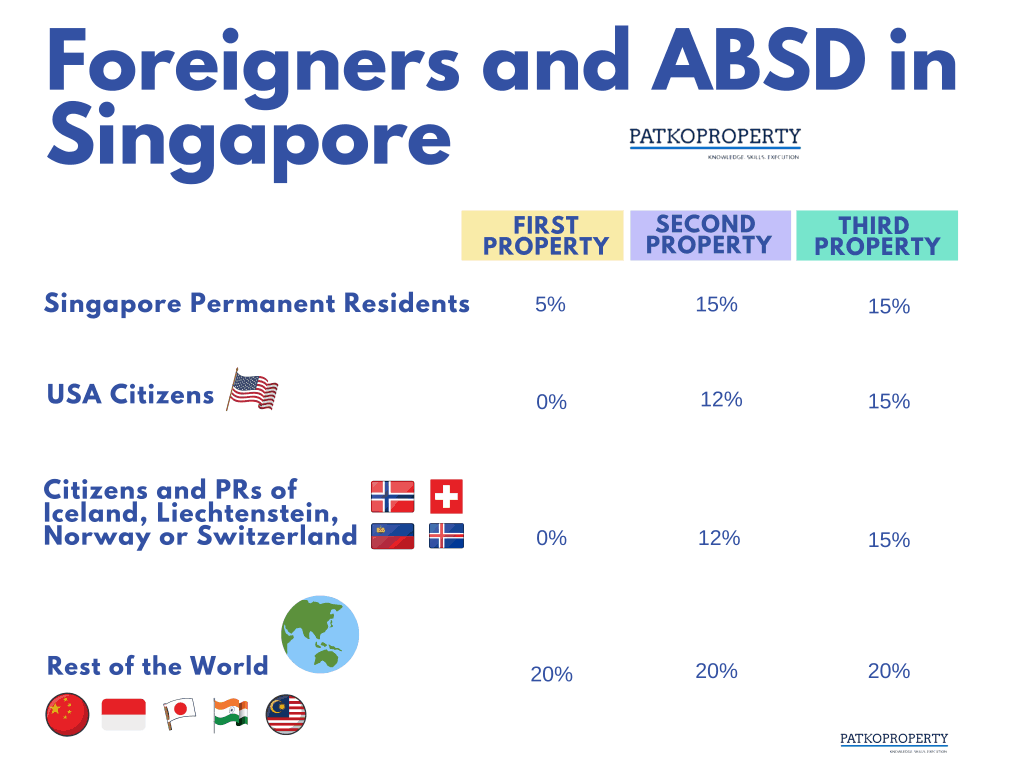

Summary of all the ABSD rates for Foreigners in Singapore

There are many charts in Singapore Real Estate web sites that showed the ABSD for Singaporeans vs Singapore Permanent Residents and finally Foreigners.

But not just one specially for FOREIGNERS in Singapore.

So here’s one from PatkoProperty. A chart that let’s you easily tell say what is the ABSD rates for FOREIGNERS in Singapore.

Latest Slide (updated on Apr 2023)

Outdated Slide but I kept here for reference

Outdated Slide but I kept here for reference

If you do use this, do give some credit to me and my web site here lah. I spent one hour with my lack of IT skills to produce it. My eyes nearly hurt from my staring at my MacBook Pro to do this little chart.

Thank you…. ha ha 🙂

Member discussion