New ABSD Rates for Foreigners in Apr 2023

After 1 year and 3 months since the last increase in ABSD for Singapore properties (the last change being in Dec 2021), today on 27th April 2023, we saw a new round of increase in ABSD (Additional Buyers' Stamp Duties). This was announced in the middle of the night by the Ministry of National Development in a press release.

The main changes are that Singaporeans now pay 20% for the second property (up from 17%), Singapore permanent residents pay 30% for second property (up from 25%) and finally the big one, FOREIGNERS pay 60% for any property (first, second, tenth).

More Details on Increase in ABSD on 27th April 2023

The specific ABSD rates increases are as follows:

Singaporeans

Raise ABSD rate from 17% to 20% for Singapore Citizens (SCs) purchasing their 2nd residential property; Raise ABSD rate from 25% to 30% for SCs purchasing their 3rd and subsequent residential property, and

Singapore Permanent Residents

Raise ABSD rate from 25% to 30% for Singapore Permanent Residents (SPRs) purchasing their 2nd residential property; Raise ABSD rate from 30% to 35% for SPRs purchasing their 3rd and subsequent residential property, and

Foreigners

Raise ABSD rate from 30% to 60% for foreigners purchasing any residential property; and

Non Individuals

Raise ABSD rate from 35% to 65% for entities or trusts purchasing any residential property, except for housing developers.

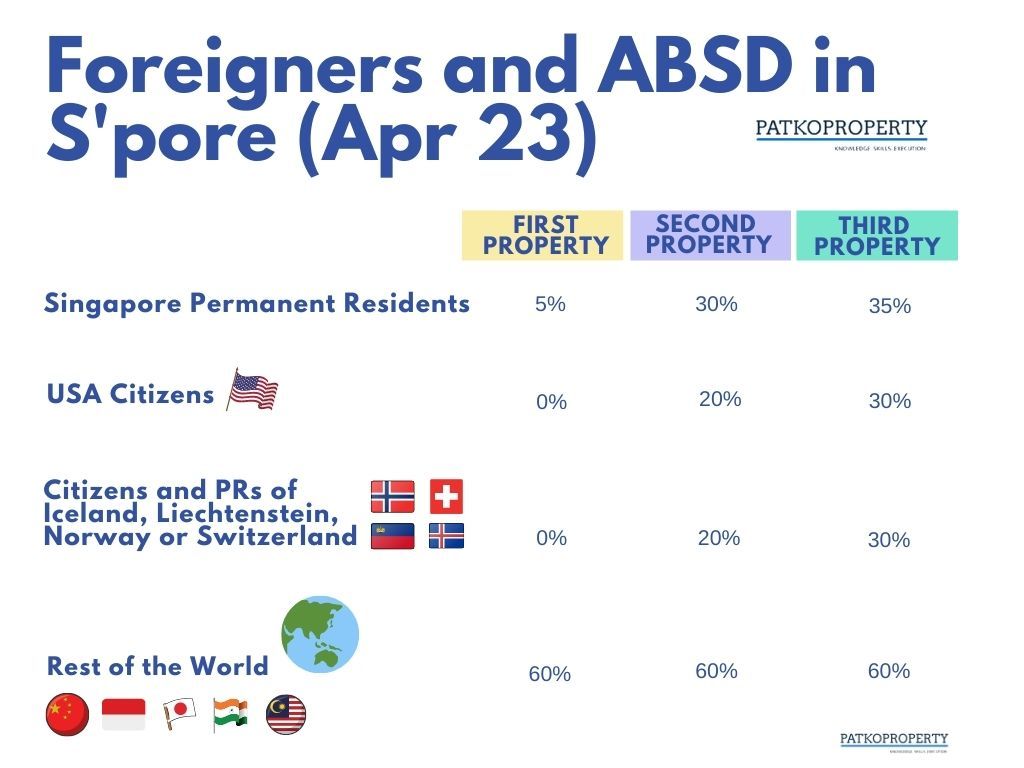

A New Infographic Slide Specifically for ABSD for Foreigners

This, of course, means a new update to my popular slide, New ABSD Rates for Foreigners in Dec 2021.

Do refer to this blog post : Foreigners and ABSD rates to understand more. This is useful as not all foreigners are treated the same. That means, even if we say foreigners pay 60%, there are foreigners from America that pay 0% !

I have now updated the slide so that you can see for a glance, New ABSD Rates for Foreigners in April 2023.

For acquisitions made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply. That means if an American with a China citizen wife buy a property in Singapore together, that would be 60% (The higher of American's 0% and China citizen's 60%).

Of course, the biggest change was the doubling of ABSD for foreigners. But even, MND said, that based on 2022 data, the above ABSD rate increases will affect about 10% of residential property transactions. The ABSD rates for SCs and SPRs purchasing their first residential property, which constitutes about 90% of residential property transactions based on 2022 data, will remain at 0% and 5% respectively.

What the market is seeing is that many new Singaporeans are buying up properties. But obviously this is not a possible to make changes to that without any significant discrimination.

But to me, the impact of ABSD (Trust) has increased from 35% to 65%.. that is a lot of impact on property agents who helped their clients to buy properties by trust (whether new launch or resale). Even if you can claim back this 65%, there is always the upfront payment.

We shall see if this new round of ABSD helps to moderate the ever hot property market.

Check out my new property launches web site too.

Member discussion