Singapore Boosts Private Housing Supply To Meet Surging Demand

Singapore has recently implemented measures to address the increasing demand for private housing in the country. In response to the surging demand for housing needs, the Government has significantly increased the supply of housing units in the second half of the year.

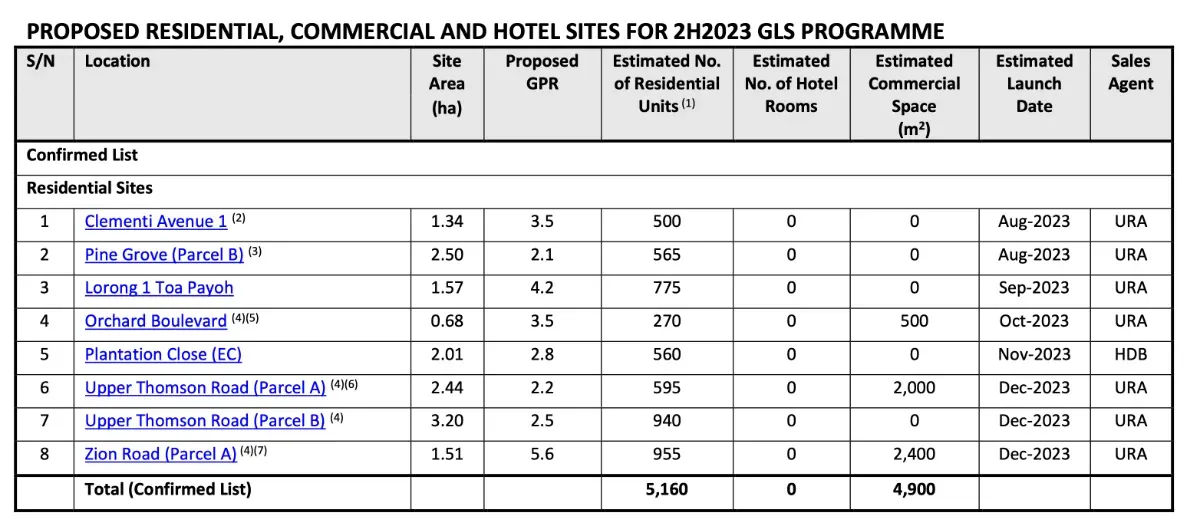

Key Takeaways of Increase in Supply of Housing Supply for 2023

- Singapore has increased private housing supply on the Confirmed List of the Government Land Sales (GLS) Programme for the second half of the year to 5,160 units, the highest in a decade.

- The total supply for 2023 will be 9,250 units, the highest in a decade.

- The new sites introduced are at Orchard Boulevard, Upper Thomson Road, and Zion Road.

- The government has stepped up its supply of land to meet strong demand for housing in its 2H2023 GLS Programme.

The Increase of Supply Details

The Government Land Sales (GLS) Programme for 2H2023 is set to offer a total of 5,160 units, which is the highest number in a decade.

The Confirmed List supply of private housing in the GLS programme has been further ramped up by 26% in 2H2023 compared to 1H2023. With the 2H2023 supply, the total Confirmed List supply of around 9,250 units for the whole of 2023 will be the highest in a decade.

Why the Supply Increase

The increase in private housing supply on the Confirmed List of the Government Land Sales (GLS) Programme for the second half of the year, as well as the highest total supply in a decade, reflects Singapore's efforts to meet the surging demand for housing.

This move comes in response to the strong demand for housing in Singapore, driven by factors such as population growth, urbanization, and favorable economic conditions. By increasing the supply of private housing units, the government aims to address the housing needs of the growing population and ensure market stability. The government is closely monitoring economic and property market conditions to ensure that future supply is calibrated accordingly.

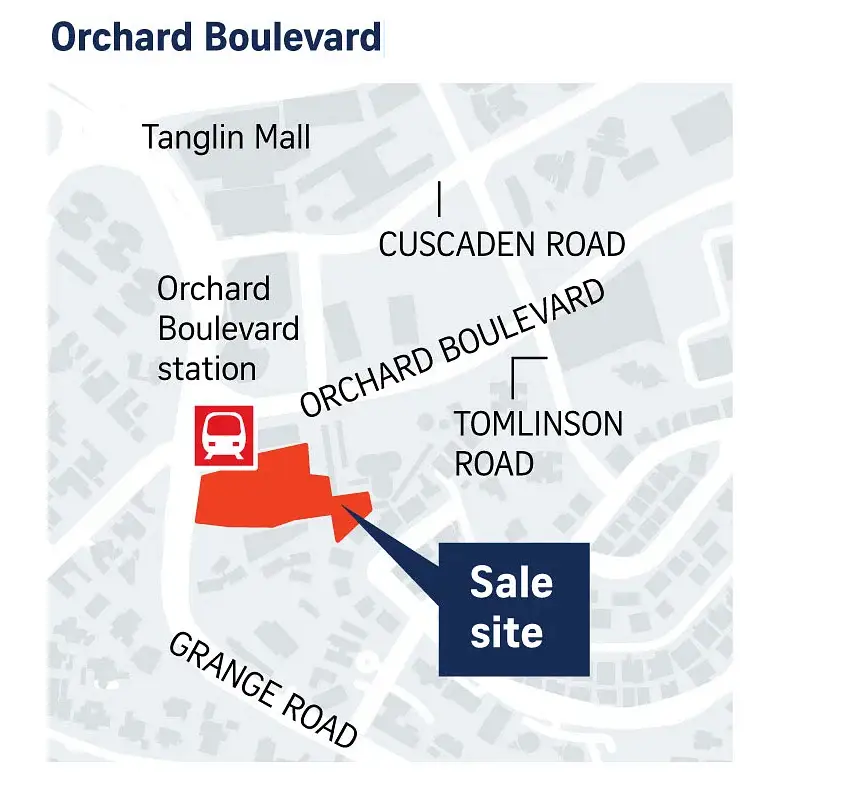

The selection of prime locations such as Orchard Boulevard and Upper Thomson Road further demonstrates the government's market-focused approach. By strategically locating these new sites, the government aims to cater to the preferences and needs of potential homebuyers, thereby stimulating the housing market and ensuring its sustainability.

The significant increase in private housing supply is expected to have a positive impact on the housing market.

With a total of 9,250 units planned for 2023, the highest in a decade, there will be a substantial increase in the number of housing options available to prospective buyers.

This increased supply will help to alleviate the current shortage of housing units and provide more choices for individuals and families looking to purchase private properties. Furthermore, the inclusion of new sites in locations where there had not been any supply for many years suggests that the government is actively seeking to diversify the housing market and cater to different preferences and needs.

Confirmed List Sites for 2nd half 2023

Confirmed List sites for the second half of 2023 include private residential sites and one Executive Condominium (EC) site. All eight Confirmed List sites are private residential sites, including one Executive Condominium (EC) site at Plantation Close, which can collectively yield about 5,160 private residential units (including 560 EC units) and 4,900 sqm GFA of commercial space.

Land on the Confirmed List is launched for sale at pre-determined dates, with most land parcels sold through tenders.

These sites are strategically located at Orchard Boulevard, Upper Thomson Road, and Zion Road, among others.

The addition of these new sites reflects the Singapore government's efforts to meet the surging demand for private housing in the country. However, it may not have an immediate impact on prices, as potential new launches may hit the market only in 2025.

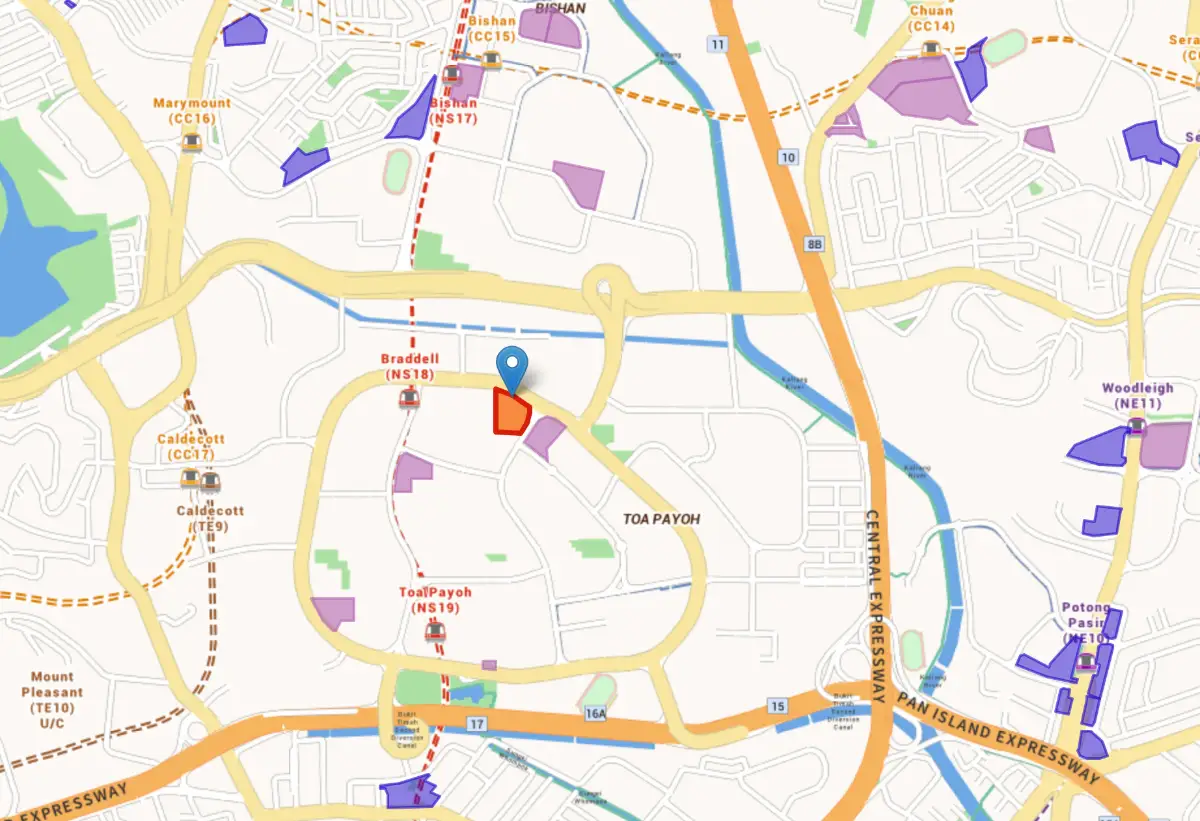

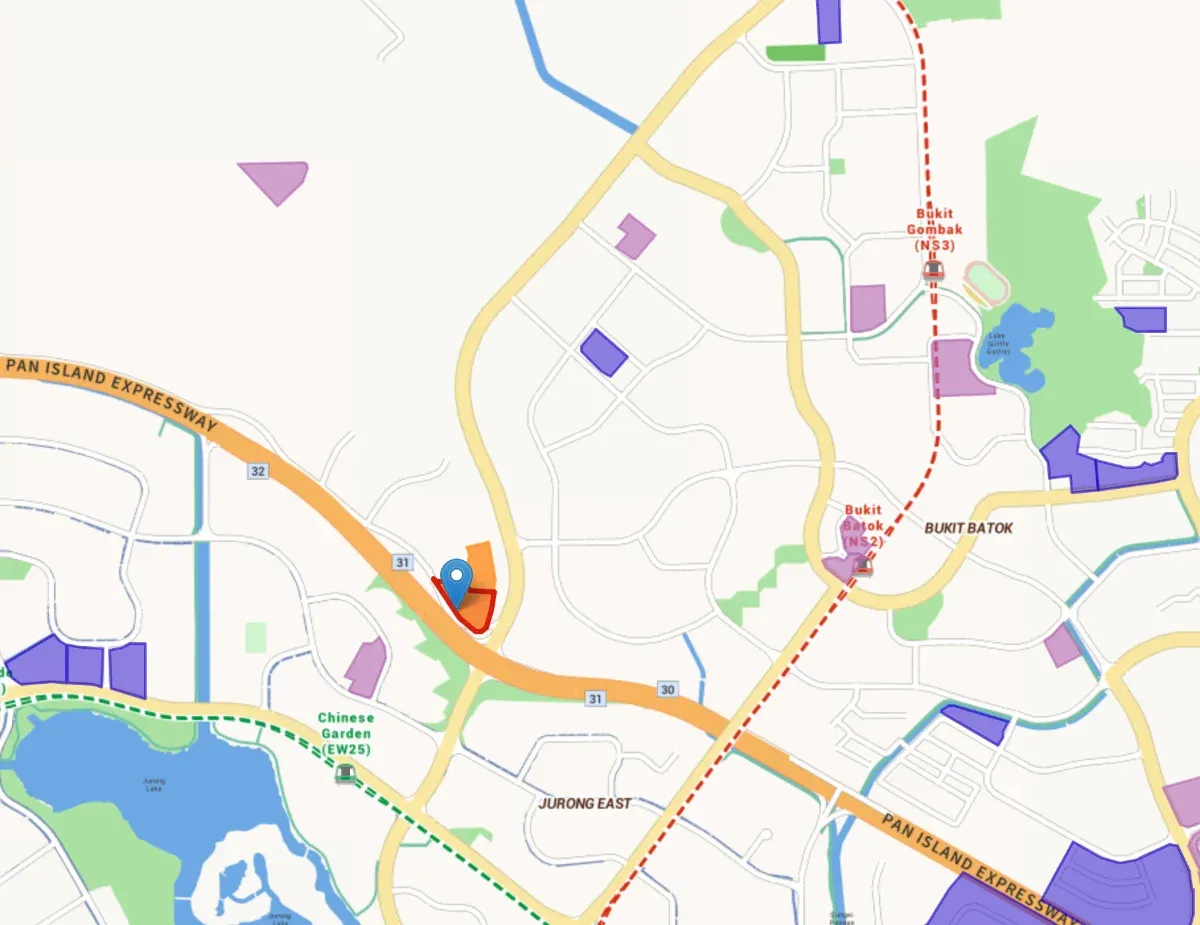

The sites on the Confirmed List are expected to attract keen interest from developers due to their prime locations. Many of these sites are directly connected to or within a short walk to an MRT station, making them highly accessible for residents. The sites at Orchard Boulevard and Zion Road would be highly watched by observers as they are at very highly valued area.

Orchard Boulevard and Zion Road Sites Details

For example, in the Orchard Boulevard area, there has not been a GLS released for sale in this area in the past five years. The last GLS site released was in Cuscaden Road – now Cuscaden Reserve (8 Cuscaden Road, across from Conrad Singapore Orchard).

For the Zion Road parcels, these could yield 1,560 residential units and it is expected a strong end-user demand, given its location and proximity to Great World City and Great World MRT station.

Other Confirmed Sites Details such as Clementi and Toa Payoh are interesting too

On the other hand, about half of the confirmed list supply is in the suburbs, where local demand remains buoyant.

Of the suburban sites, the Clementi Avenue 1 site – wedged between Clavon and The Clement Canopy – will be appealing given its location and proximity to numerous schools.

It has been eight years since the last GLS for private housing in Lorong 1 Toa Payoh. There is now a sizeable pool of Housing Board upgraders, with keen interest to sell their HDB flats in Toa Payoh to upgrade to private properties. The site which can yield 775 units, is pretty close to Braddell MRT station.

The EC site is at Plantation Close. This will be interesting to see how it fares against the upcoming Altura EC at Bukit Batok West Avenue 8.

Reserve List Sites for Second Half 2023

The Reserve List sites for the second half of 2023 provide additional opportunities for developers to capitalize on untapped markets and enhance the accessibility of housing options in prime locations. These sites, which are not released for tender immediately but made available for application, offer potential for developers to address the growing demand for private housing in Singapore.

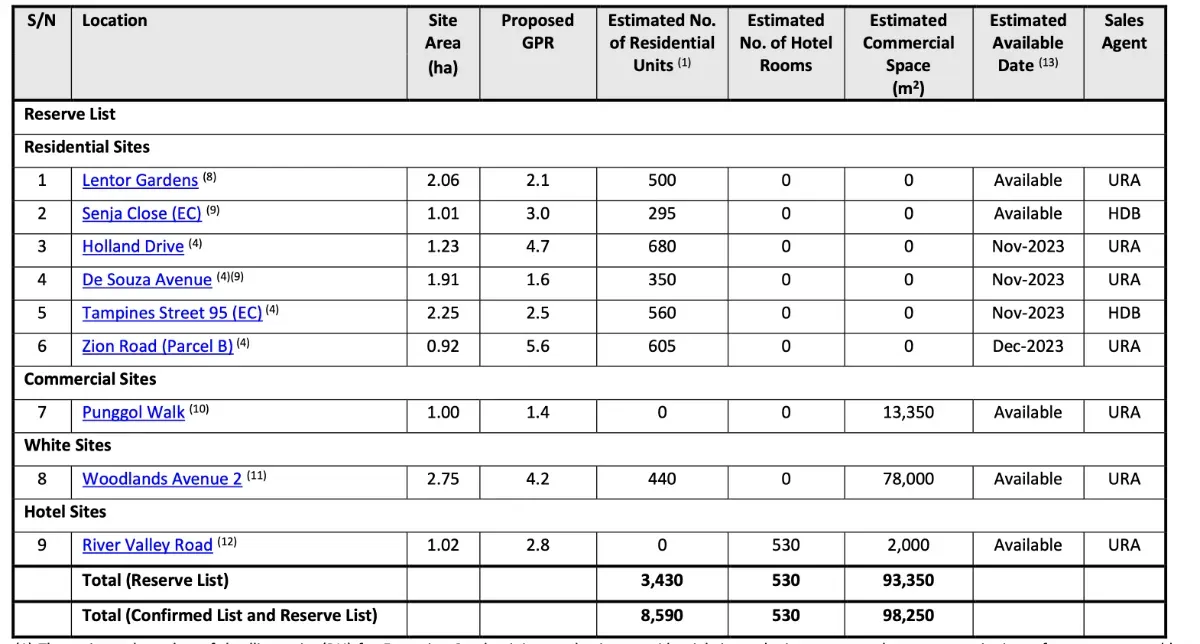

The reserve list comprises six private residential sites (including two EC sites), one commercial site, one white site and one hotel site.

Tampines EC and Holland Drive are likely the winners of the Reserve List

Among the reserve list sites, the Tampines Street 95 (EC) site is most likely to be triggered for sale. The Holland Drive site, located near the Holland Village MRT station, will ride on the rejuvenation of the Holland Village precinct by the One Holland Village project. A close by new launch now available is the One Holland Village Residences.

Among the reserve list sites is the white site for a mixed-use development in Woodlands Avenue 2 and the short-term lease commercial site in Punggol Walk. Also included is a site in River Valley Road carried over from the first half 2023 reserve list, for the potential development of more hotel rooms.

The Reserve List sites offer developers the flexibility to submit their proposals and bids, allowing for a more dynamic and market-responsive approach. By including these sites in the GLS Programme, the government aims to encourage developers to bring forth innovative and sustainable housing solutions that cater to the evolving needs of homebuyers.

Moreover, the Reserve List sites serve as a strategic tool to ensure a steady supply of land for development, while also maintaining a balance between supply and demand in the housing market.

The inclusion of Reserve List sites in the second half of 2023 GLS Programme offers developers the chance to tap into untapped markets and enhance housing accessibility in prime locations.

These sites provide flexibility and promote market responsiveness, allowing developers to propose innovative housing solutions that cater to evolving buyer needs. With the strategic location of these sites and their proximity to transportation hubs, they hold significant potential for meeting the surging demand for private housing in Singapore.

Member discussion