Ten Common Questions on Executive Condos

The Executive Condominium (EC) Housing Scheme was introduced to provide an affordable option for Singaporeans who aspire to own private housing. I will try to share the answers to ten very common questions on Executive Condos here in this article. So that you can look and sound very smart in any new Executive Condo new launch showroom and asked the very important question like whether the marble flooring is from Italy or China etc and the brand of the home appliances which I usually have problems pronouncing.

First built in 1999, EC is an unique feature of Singapore public housing world in that it is a hybrid of public and private housing, with its own special set of rules. Unheard and unseen before in the rest of the world. What’s new. We are Singapore, the land of POFMA.

ECs are marketed, built and sold by private developers, but at a much lower price than private homes because their land prices are supposedly subsidised by the Government. Because they are built by developers as a “condominium”, ECs offer similar design features and facilities as the private condominiums.

They are hence fenced up (unlike HDB flats where anyone can knock on your door, like me knocking on your door to convince to sell your HDB flats) and with full time security (which might be subjected to abuse if they tell you that your visitors cannot park in certain lots) and full condo amenities like swimming pools, clubhouses, playgrounds and most importantly, a gym ! A gym to lose those fats !!

While ECs have been around for a while, we still get the same common questions on Executive Condos so here’s the answers to the more TEN common questions on Executive Condos

Ten Common Questions on Executive Condos

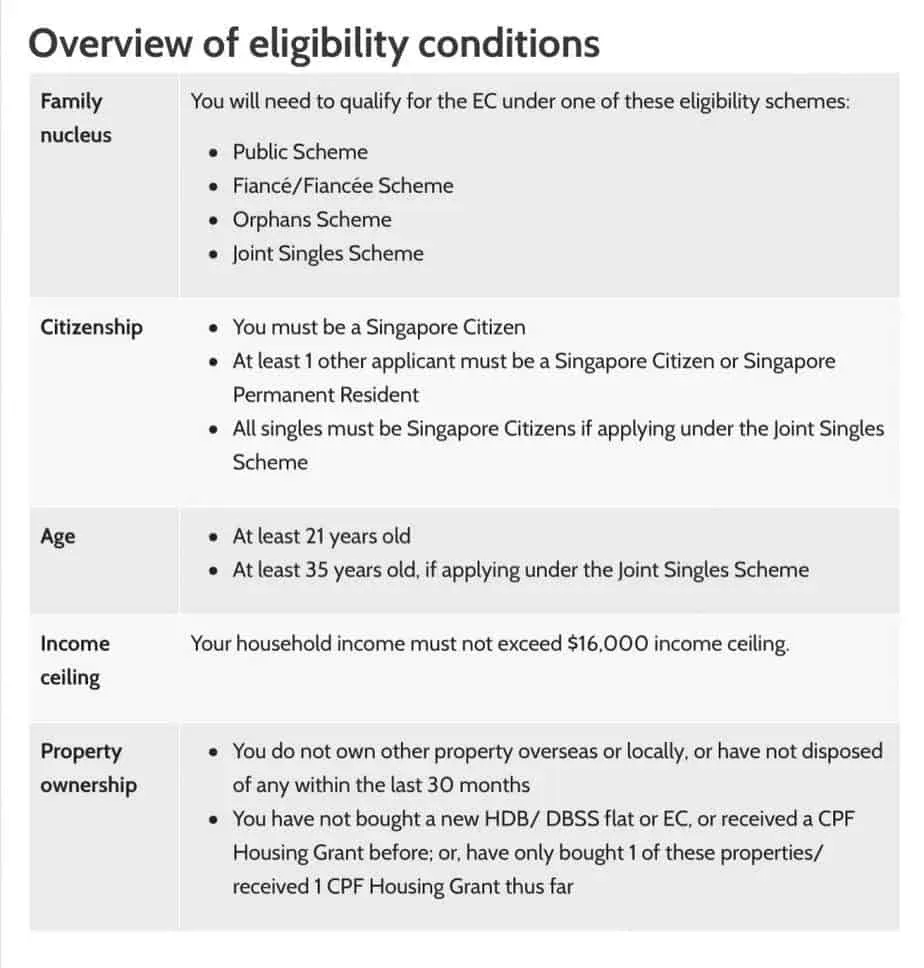

How can I qualify for a EC

Question 1 of common questions on Executive Condos is always “can I buy a EC huh ?”. Guys need to ask this questions before they pop the question to the girls, Singapore-style.

Don’t be deceived by the words, “condominiums”. This is no private condo where anyone can buy an unit (single, married, divorced, widowed, you with your dog etc). There are no rules to buy a private condo. Only money. Cold hard cash (or bank loan).

The Executive Condominium Housing Scheme (ECHS), on the other hand, was creatively designed to meet the aspirations of Singaporeans to own private housing in an affordable way. The cynics will say this is one way of keeping the Singapore Dream alive among the Singapore people.

As such, an EC is subject to certain regulations that originally only apply to Housing and Development Board (HDB) flats. This is done by imposing on EC buyers certain initial purchase eligibility and later, ten more years of ownership restrictions.

There is a price for everything, brother.

You can see the full list of EC eligibility conditions (https://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/executive-condominium) here.

The key is at least one of the applicant is a Singaporean. Hence, no PRs only family can qualify. Foreigners also cannot apply for a EC (read about foreigners’ restrictions on housing in Singapore).

You also need to form the famous “family nucleus” of the HDB. This means in most cases, you need to be married. Or can form a family nucleus with your child. Your cat does not cound. And unless you are over 35, singles cannot buy ECs. You need to buy it with another single under Joint Singles Scheme.

You also need to not to be earning a ridiculous amount like certain people in Singapore. This means if you and your “family nucleus member” earn more than $16,000 per month, you cannot buy ECs.

But then if you earn that amount, please come buy a new condo launch with me. Less rules. I promised….

Can I buy EC if I own a private property?

If you, your spouse, or any family member listed in the EC application owns a private property in Singapore or even overseas, you are not eligible to buy an EC condo. Same applies under Joint Singles scheme if you don’t own a private property but your partner does.

Even if you have disposed of your private property, you may only apply to buy an EC after 30 months from the date of disposal of the private property.

Read about the 30 months in yet another “famous” article of mine (ya. right. I have “lots” of famous articles.. Ya right…).

It is subsided housing, for your information 🙂

At first I decided to buy a BTO flat and then I visited the showroom and fell in love with the EC...... And now I want to….

I have applied for a BTO flat from HDB but have not booked the flat yet. Can I apply now to buy an EC unit ?

Yes, if you have not booked a BTO flat with HDB, you can apply and book an EC unit directly with the developer through me :). HDB will then cancel your BTO flat application after you have booked an EC unit. You lose a bit of application kopi money only. Everyone can apply mah. Not the same as “booked” a flat.

I have booked an HDB BTO flat and have signed the BTO Purchase Agreement with my fiancé. Can I buy an EC Unit?

If you have booked a BTO flat and then decide to cancel the booking, there will be booking cancellation costs in the HDB side of the world and then you will not be eligible to apply for an EC unit within one year after the cancellation. Don’t anyhow okay. Your fiancé might kill you.

Ok. I “bought” a EC and now changed my mind…

Why you so fickle minded one !!!

What is the forfeiture if I were to give up my EC Unit after paying the Booking Fee of 5% and obtained the “Option to Purchase” but before I signed the Sales and Purchase (S&P) Agreement?

If you give up your EC unit before you execute the Sale and Purchase Agreement with the developer, the developer will impose a forfeiture of 25% of the booking fee. That means 25% of 5% of the purchase price (as your booking fee is 5% of the purchase fee). Go calculate yourself how much that costs.

I have signed the Sale and Purchase Agreement for an EC unit and now super duper regret and don’t want to carry on the purchase of the EC ?

Wow, brother. This one very serious one leh. Legit.

If you have signed the Sale and Purchase Agreement and don’t want to carry on the sale, the developer can impose a forfeiture of 20% of the selling price upon termination of the Sale and Purchase Agreement and may take such other action as set out in that Sale and Purchase Agreement.

This is a lot of money !!! Don’t play play. Think carefully first, okie !

What is this Deferred Payment Scheme that I heard my agent talking about

There are developers who offer both Normal Payment Scheme (NPS) and Deferred Payment Scheme (DPS). This is simply the right of the developers to decide how they want to finance the sale of the executive condos so that they can sell the product (They are taking the risk of no-sale).

Are there any differences between the two schemes ? Yes, there are differences between the two schemes.

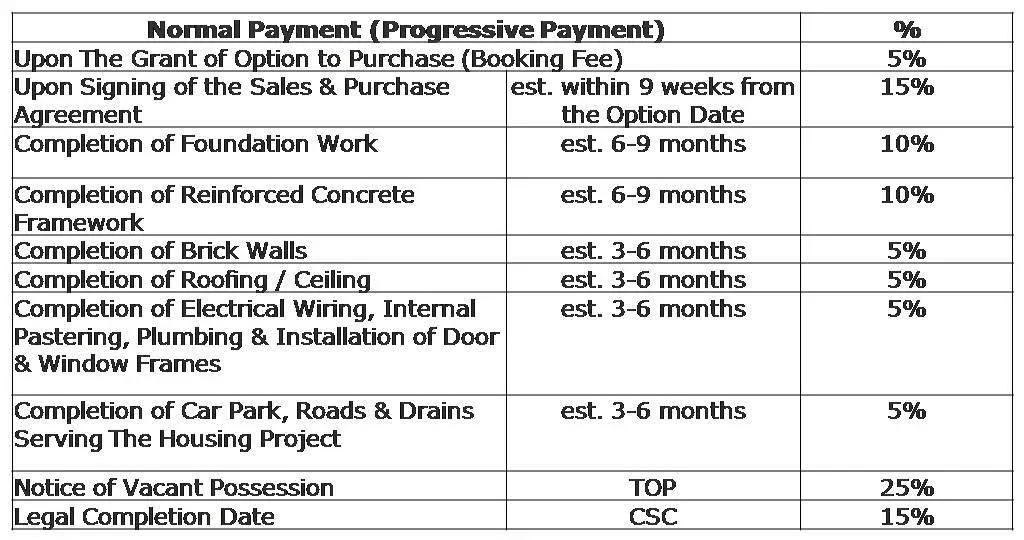

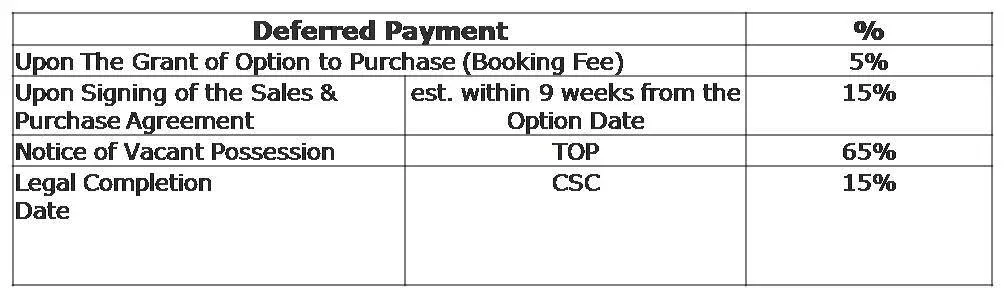

Normal Payment Scheme (NPS) refers to the payment schedule set out in the standard Sale and Purchase Agreement. An example of a NPS :

Deferred Payment Scheme (DPS) is a payment scheme where the developers allow purchasers to pay in a manner other than the standard payment.

An example (note this is just an example. Every developer has their own scheme. Check with your agent).

If you have opted for DPS, this may affect the selling price of your EC unit (usually the selling price is higher). You should carefully consider this and talk with your developer friendly property agent first.

Ok.

Onwards to more common questions on Executive Condos

Will I get any CPF Housing Grant from my Govt for my EC Purchase

If you are eligible for the CPF Housing Grant, it will be credited into your CPF account. The first 5% of the selling price must be paid in cash. By You. From Your Wallet.

You can then use the CPF Housing Grant to pay for the remaining down-payment (i.e. 15% of the selling price) after you have signed the Sale and Purchase Agreement.

For eligible applicants that are husband and wife and are both Singapore citizens, the CPF Housing Grant will be divided equally and credited into their respective CPF accounts. For the other cases, the CPF Housing Grant will only be credited into the CPF account of the applicant who is a Singapore citizen and has not taken any housing subsidies before.

In other words, the CPF housing grant goes (automatically) to your CPF account(s), and then you apply through the lawyers to use them. They don’t go directly to the developers and they don’t go directly to your bank accounts either.

When I sell my EC unit in future, do I need to refund the CPF Housing Grant to My Government?

Not “Return to the Govt” or “My Government” lah. The Govt does not want the money back.

The money is refunded to your own CPF account la. This one is always asked as one of the most common questions on Executive Condos.

When you disposed of your EC unit, you are required to refund all the CPF monies (including the CPF Housing Grant which had been withdrawn for the purchase of the EC unit) back to your CPF account(s). Again read my “famous” article on CPF Refund. Then the money becomes available for use again for your next property purchase.

Please note that the CPF monies returned to your CPF account can only be then used in accordance with the prevailing CPF laws and policies. A most common restriction is the need to maintain the Full Retirement Sum (FRS) in your CPF accounts once you are 55 years old or more at the time you sold the EC.

What is this “five years local, ten years foreigners” rule ?

As EC are treated as subsided housing, it is subjected to HDB MOP rules. You can read my “famous” article on the different MOP rules for HDB and ECs here in this link. Be careful about renting out your EC during the 5 years MOP and also the whole section of your Dual-Key EC unit.

For direct purchases from a developer, there is a minimum occupancy period of five years; during which the EC cannot be sold or rented out whole. After five years, the EC can only be sold to Singaporeans or Singaporean Permanent Residents (PRs). It can only be sold to foreigners after 10 years from development completion.

Hence, the first milestone is the MOP of 5 years (like all BTO and resale flats). After that five years, you can sell the EC to locals. Locals refer to Singaporeans and Permanent Residents.

The second milestone is that after the 10th year, all restrictions are lifted and the EC will be no different from other private condominiums. EC are finally as strata-titled private housing after ten years. It can then be sold not just to locals, but like normal condos, it can be sold to anyone who is willing to buy (and pay ABSD if they are foreigners).

Ten years before it becomes a private condo. Ten years.

Let’s finish up on more common questions on Executive Condos.

Who is responsible for defects

You might heard of some issues with some ECs and the defects as sometimes they are covered (too) extensively by the media.

When there are issues, who is responsible ?

HDB (whom we are used to looking for whenever there are issues with our flats) or the developers (whom, unless you have bought a condo before, seemed to be far away).

The answer is that because buyers purchase their ECs directly from the private developers and hence it is the developers who must make good on the defects. Ministry of National Development and HDB are not involved here. They only provide the subsided land and the guidelines on eligibility. Everything else falls on the developer.

As the Sale and Purchase (S&P) Agreement signed between the EC developer and home buyers, the EC developer is responsible for all defects during the standard 12-month Defects Liability Period.

The EC developer is also contractually obliged to attend to all feedback from buyers on the design, finishing, workmanship or other concerns pertaining to the development, and respond to the buyers accordingly.

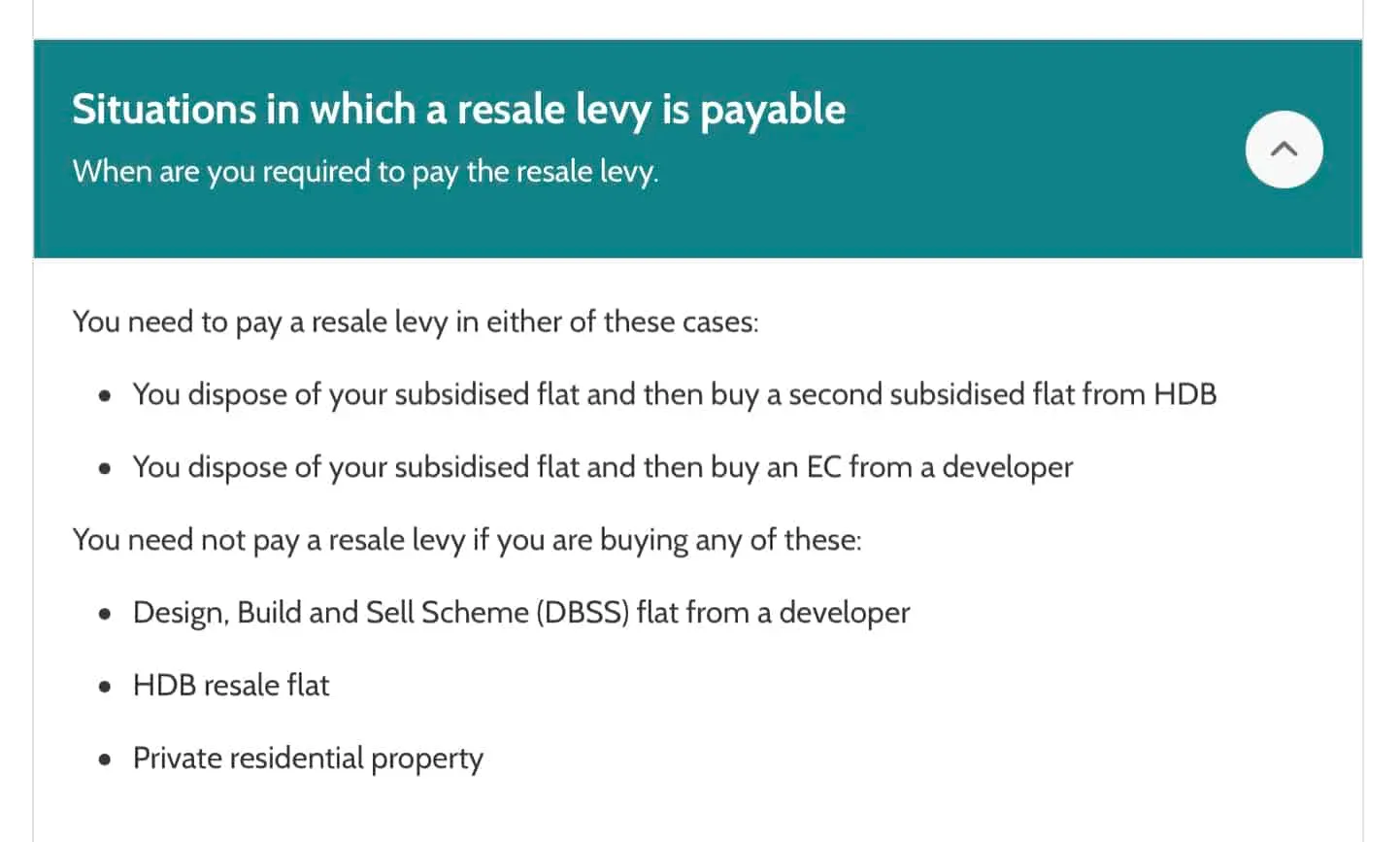

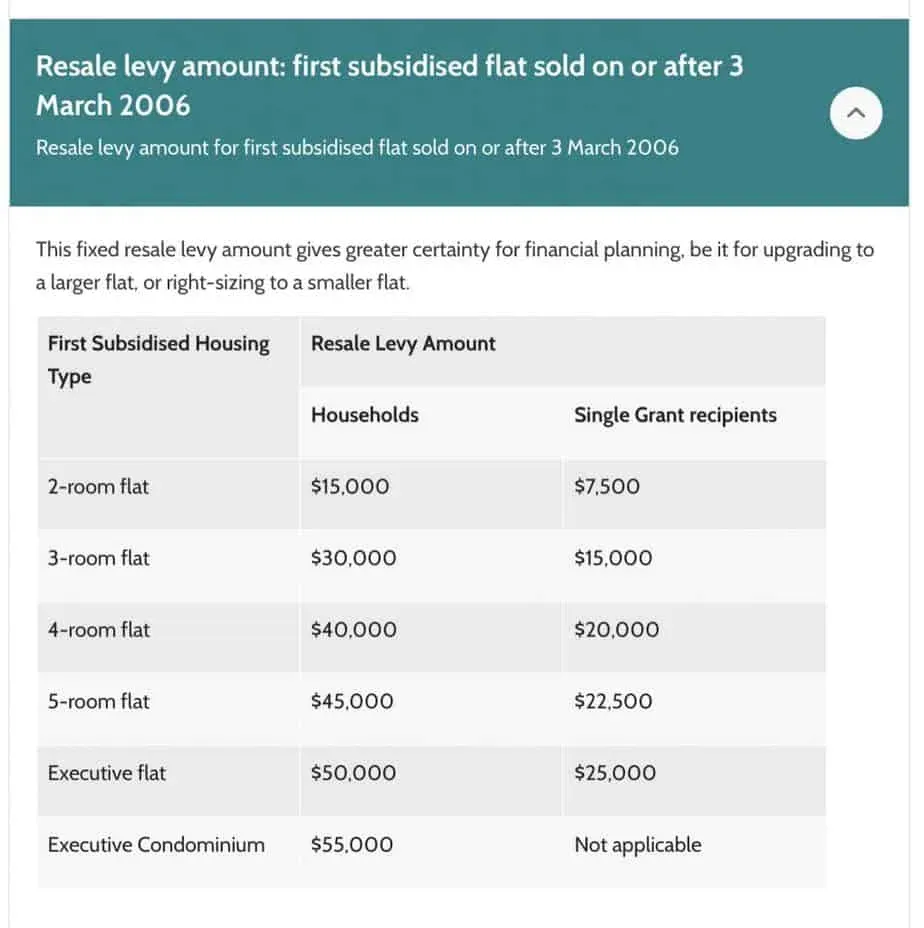

What is this EC Resale Levy I heard

In December 2013, HDB announced that EC will now be subjected to the Resale Levy. This is a lumpsum payment made to HDB when you purchase a second subsidised home. However, this only applies to ECs whose land sales were launched on or after 9 December 2013.

You have to pay a resale levy if you

(1) Bought a HDB new BTO flat first, waited five years and sold it and now wants to buy a EC

(2) Bought a EC first, waited five years and sold it and now wants to buy a new BTO flat

As both BTO and EC are considered subsidised homes, you are hence subjected to Resale Levy. You have eaten the cake and now want to eat it again. No such thing 🙂

You do not have to pay a resale levy if you

(1) Bought a HDB resale flat, waited five years and sold it and now wants to buy a EC

(2) Bought a EC, waited five years and sold it and now wants to buy a resale flat

Here’s more details from the horse’s mouth:

How much is the resale levy ?

That’s all for my ten common questions on Executive Condos

Hope you find these useful. Of course, you have more questions so do speak to a good qualified Property Agent before going to the showroom.

Member discussion