CPF Basic Retirement Sum 2023 to 2027

On 18th Feb 2022, the Minister for Finance announced the 2022 GST Budget (Details here). As part of the budget, he also announced the CPF Basic Retirement Sum 2023 or in fact, all the CPF Retirement Sums from 2023 to 2027. So what are the figures ?

CPF Basic Retirement Sum 2023

Let’s get this out of the bat.

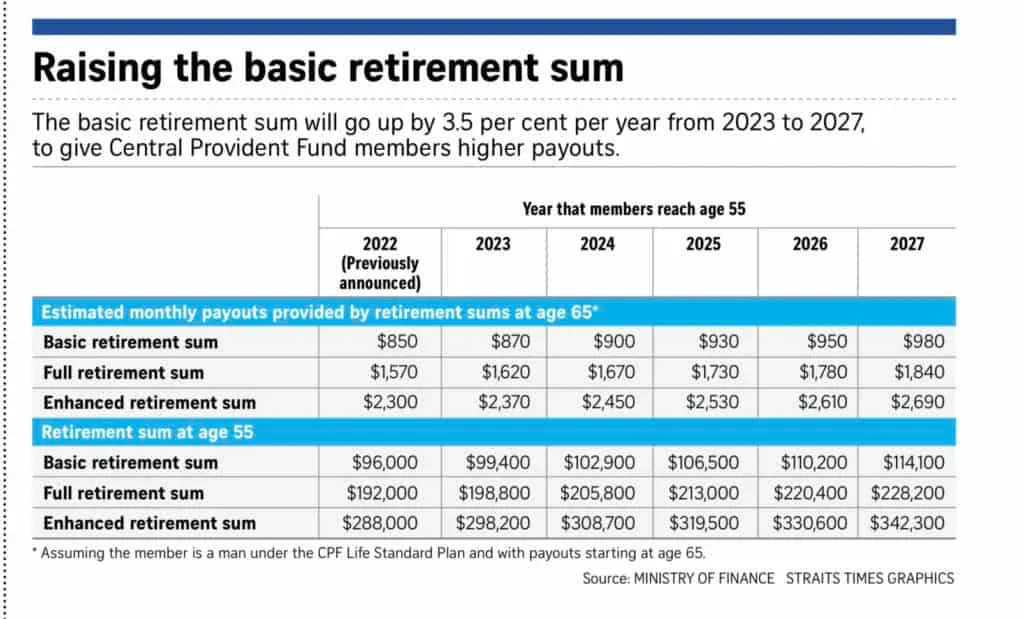

The CPF Basic Retirement Sum for 2023 is $99,400. The CPF Basic Retirement Sum in 2022 is $96,000. That’s a 3.5% increase as per the Finance Minister’s point that we need to do so to “provide retirees with higher monthly CPF payouts in their retirement years, given the rising standards of living” (Budget 2022: CPF Basic Retirement Sum to be raised by 3.5% per year from 2023 to 2027).

In fact, given this increase of 3.5%, the CPF Basic Retirement Sum will be $99,400 in 2023, $102,900 in 2024, $106,500 in 2025, $110,200 in 2026, and $114,100 in 2027.

The CPF Full Retirement Sum (FRS) in 2023 is $198,800 or twice the BRS (Basic Retirement Sum). If you have a lot of money in your CPF (and dun want to scream “Return My CPF” at election rallies or online forums), then the ERS (Enhanced Retirement Sum) is $298,200 (or three times the BRS).

CPF Retirement Sums 2023 to 2027

In fact, all five years of BRS and FRS and ERS were announced in Parliament on 18th Feb 2022. You can read my article on the BRS and FRS for the previous years in this article.

Here’s a Straits Time infographic on the numbers for the next 5 years. Memorized them if you are turning 55 years in the next 5 years. Memorize the 3 numbers (BRS, FRS and ERS) every year at the start of the year if you are a Real Estate Agent.

16th Feb 2024 Update: Note that the ERS amounts have been increased to 4 times the BRS amounts. So the table is no longer accurate for ERS. The BRS and FRS are still right. See this article CPF ERS Amount Goes Up in 2025.

Why are these numbers important for a property buyer or seller at 55 years old or later

You will hear your favourite real estate agent mention these numbers whenever they are doing some kind of mathematical calculations for you. So why are these numbers important ?

Aside from the property field, on its own, the CPF Retirement Sums affect how much your Retirement Account (RA) will be funded at 55 years ago. This then affects how much monies you get a year starting from 65 years old from the new (and dare I say, very good) CPF Life scheme. These are well written by many bloggers so I should not try to add on them.

But why are these numbers important for a property buyer or seller at 55 years old or later

For example, when you sell a property, you need to refund any CPF used (and the accrued interest it incurred) back to CPF. You can then use the CPF monies again for your next property.

For a property buyer or seller at 55 years old (or later), there are rules though to stop you from using ALL your CPF monies again.

If you are 55 years and older, you can only use any CPF monies after you have set aside the FRS (Full Retirement Sum) for your cohort. For example, if you turn 55 years old in 2023, you need to first set aside $198,800 in your CPF accounts before you can use the rest of your monies. If you are using the monies to buy a property, you can later “pledge the property back to CPF” and (which, if I am allowed to simplify the process as there are some rules on this too), you then withdraw 1/2 of the $198,800 (or to meet Basic Retirement Sum)

Hillock Green Launching Soon

Right Close to Lentor MRT. Greenery Location. Good Entry Price.

Why are these numbers important for someone 55 years old and younger

When you are young, it is hard to see how the BRS, FRS or even ERS really affect you as you are still trying to build up your retirement savings. Nay, I doubt you are even trying to build up your retirement savings but trying to survive in this hard cold world.

But it does matter for a certain group of property buyers.

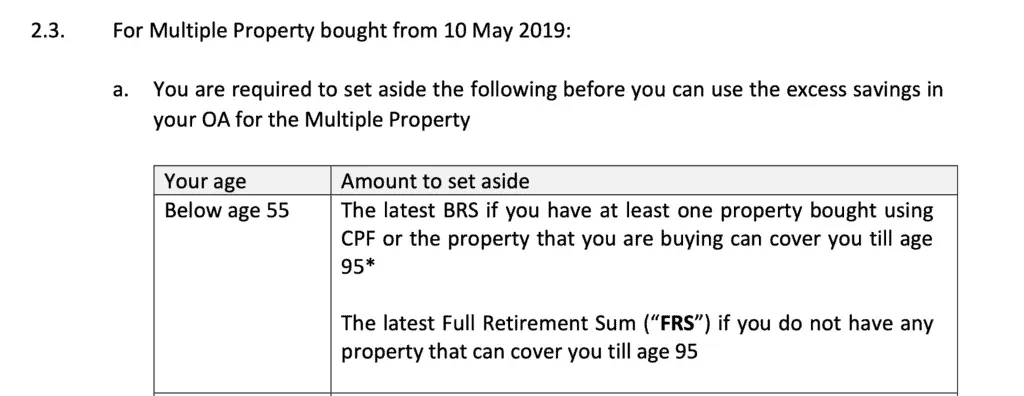

Imagine your are 40 years ago. If you have already used your CPF for your first property to pay for the downpayment of a HDB flat. Somehow you still have more CPF monies left (it is not easy but maybe it is the case for some of the more affluent ones). And now you want to buy a second property. Using CPF.

The rule said that “you need to set aside the latest BRS if you have at least one property bought using CPF or the property that you are buying can cover you till age 95”. And in fact, you ned to set aside the latest Full Retirement Sum (“FRS”) if you do not have any property that can cover you till age 95.

Summary of CPF Retirement Sums 2023 to 2027

The CPF Basic Retirement Sum 2023 has been announced. In fact, all 5 years (2023 to 2027) of BRS, FRS and ERS have all been announced.

As a prudent property buyer or seller, it is important to note all these figures during your purchase of the properties or when you are planning your retirement life. Like it or not, CPF is part of your life. From the day you are born to the day you are gone, CPF walks with you all the way. CPF Life is a critical part of our retirement benefits and hence knowing the CPF Basic Retirement Sums or Full Retirement Sums are very important in planning your finances.

Talk to your licensed financial planner if you are not sure. Talk to your property agent if you are not sure how it will affect your property purchase or sale. Just don’t stay un-informed.

Member discussion