Do PRs in Singapore need to pay ABSD

Do PRs pay ABSD ? That’s a common question from buyers of Singapore Properties.

So do the SPR (Singapore Permanent Residents) pay ABSD (Additional Buyer Stamp Duty) ? Of course they do. As you are probably aware, PRs pay 5% ABSD for the very first property they purchased in Singapore.

But there are circumstances where they do not pay any ABSD. So let’s explore some of them.

Do PRs pay ABSD

Yes they do. You can read about my article on foreigners and ABSD. It is very clear about whether foreigners have to pay ABSD and the circumstances in which they pay (or not pay) ABSD. There is even a nice chart to help you !

But for Singapore Permanent Residents (PR), it is slightly more unique as they do qualify for resale public housing (or HDB flats) and they also do marry Singaporeans or they combine with Singaporeans to buy properties. So it is really slightly more complicated.

Fear NO.

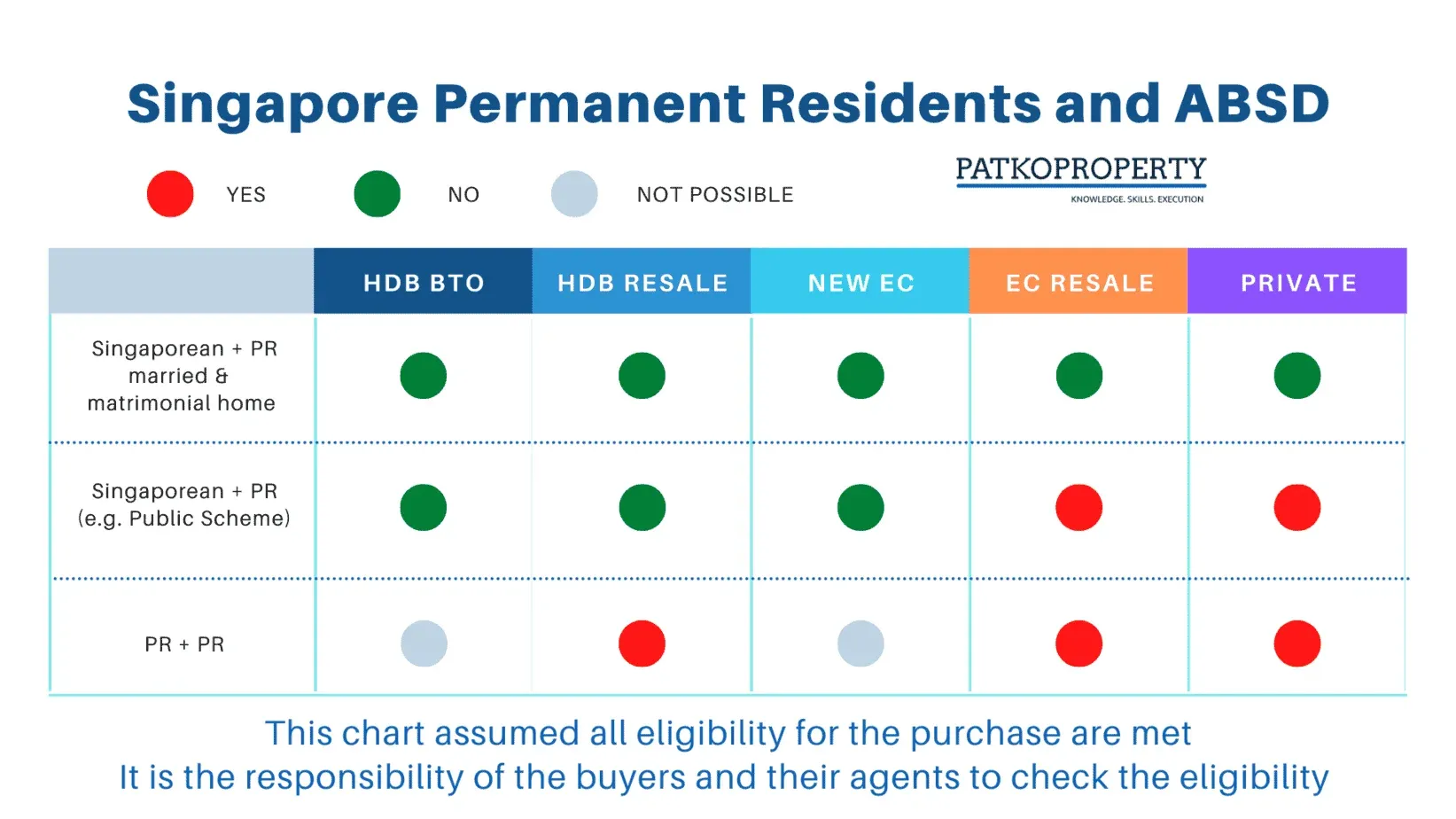

PatkoProperty has (tried to) summarise the different scenarios here in this little chart.

Hope it is accurate and helpful. Do let me know if you feel differently. It is a tough topic to make it easy to understand.

That’s all you need to read if u are in a hurry 🙂

But if you want more details, read on about whether “Do PRs pay ABSD” ?

PR and Singapore Citizen with their matrimonial home

When a PR marries a Singapore Citizen and they then buy their matrimonial home (and their only home), there is NO ABSD. So the PR pays no ABSD (it is also the case for a foreigner who marries a Singapore Citizen).

This is despite the fact that a Singaporean Citizen has 0% ABSD for a first property and a PR has 5% ABSD for a first property. The higher of the two is the 5%. But there is no ABSD if they are a married couple (and stay a married couple).

And this applies to all homes. HDB Flats. Executive Condos. Private Property. ALL (everything). This is probably the way to encourage people to get married and hopefully have kids. It is only right. This is their first property. It does not matter whom the Singapore Citizen marry, right 🙂

This is best summarized by this excellent PDF file (https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Property/Claiming-Refunds-Remissions-Reliefs/Remissions/Remission-of-ABSD-for-A-Married-Couple/)

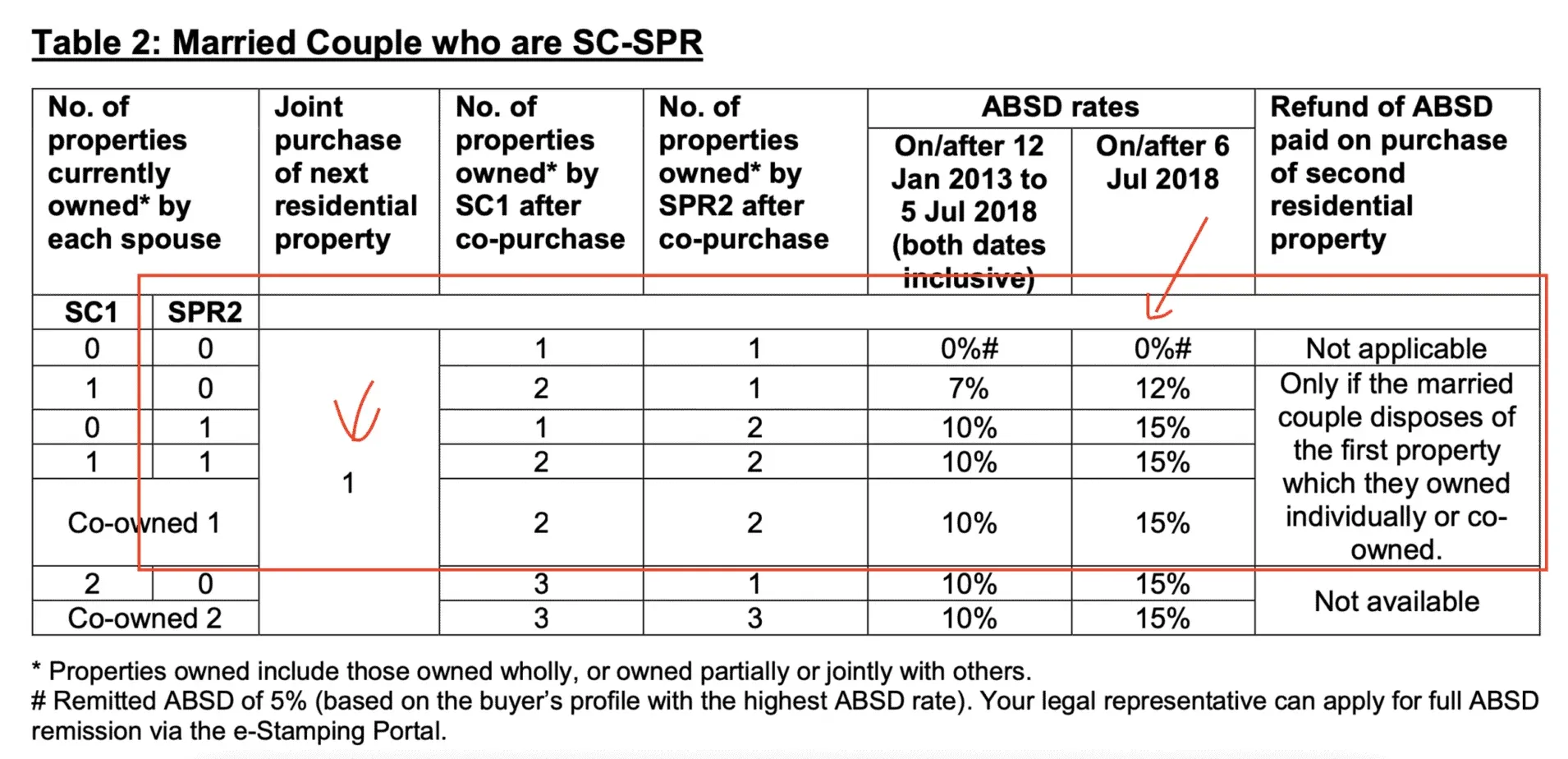

ABSD Rates and Remission for Married Couples

(A) Joint Purchase Made by a Married Couple who Does Not Own Any Residential Property

A married couple with at least one SC spouse jointly purchasing a residential property, where both the spouses do not own any residential property at the time of purchase, can apply for full ABSD remission.

(B) Joint Purchase of Second Residential Property by a Married Couple

A married couple with at least one SC spouse is eligible for ABSD refund on their second property if they sell their first property within 6 months^ after the date of purchase/TOP/CSC, whichever is applicable. During the Covid period, this was extended (subject to certain conditions) to 1 year.

This chart summed it all up. End game. As long as it is their first property as a MARRIED couple, there are no ABSD.

Happy Couple enjoying 0% ABSD 🙂

PR and Singapore Citizen who are NOT married but are eligible to buy a HDB flat

Assuming the Singapore Permanent Resident (PR) and a Singapore citizen are eligible to buy HDB flat (e.g. under Public Scheme, maybe a Singapore child and his PR parents), then there is NO ABSD too.

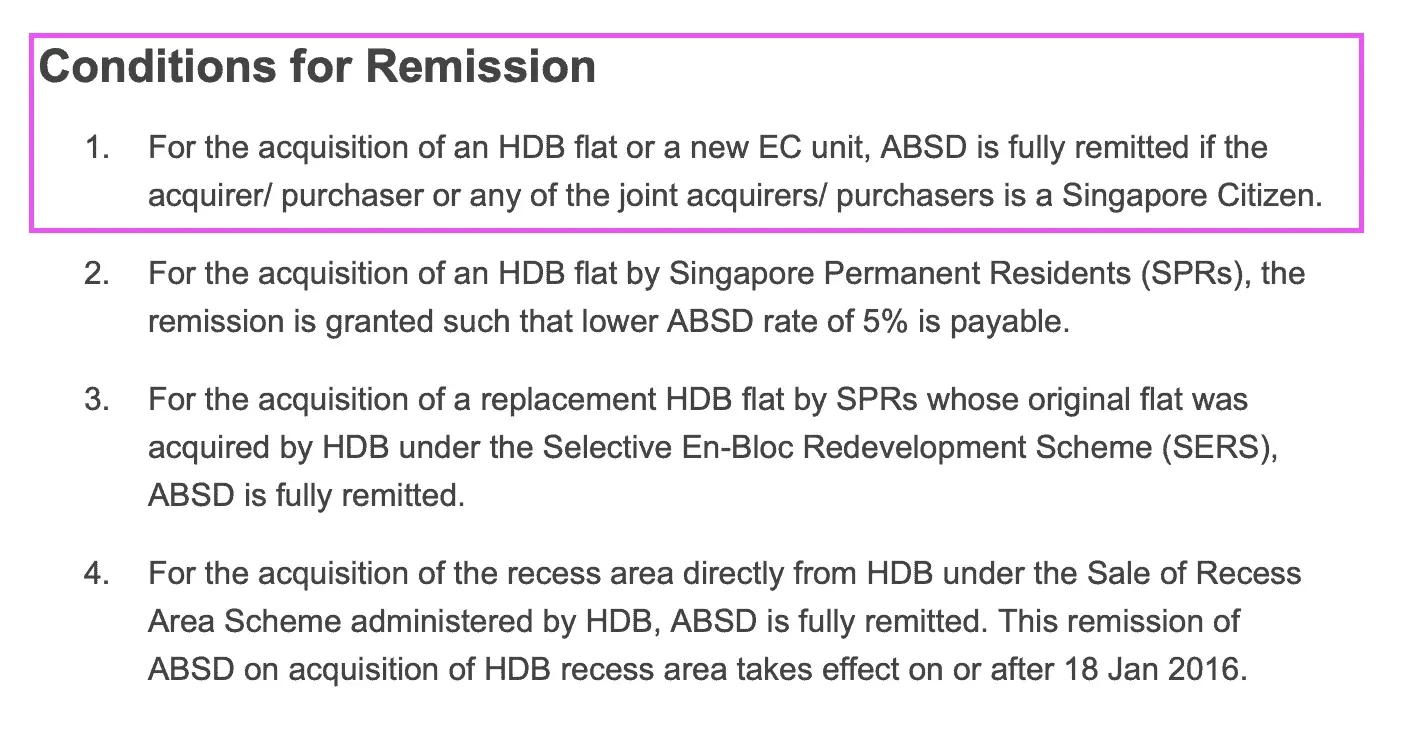

For the acquisition of an HDB flat or a new EC unit, ABSD is fully remitted if the acquirer/ purchaser or any of the joint acquirers/ purchasers is a Singapore Citizen.

This only applies to 3 cases (assuming that all the eligibility is met ! Please check eligibility with HDB or your friendly agent).

(1) New BTO HDB flat

(2) Resale HDB Flat

(3) New Executive Condo

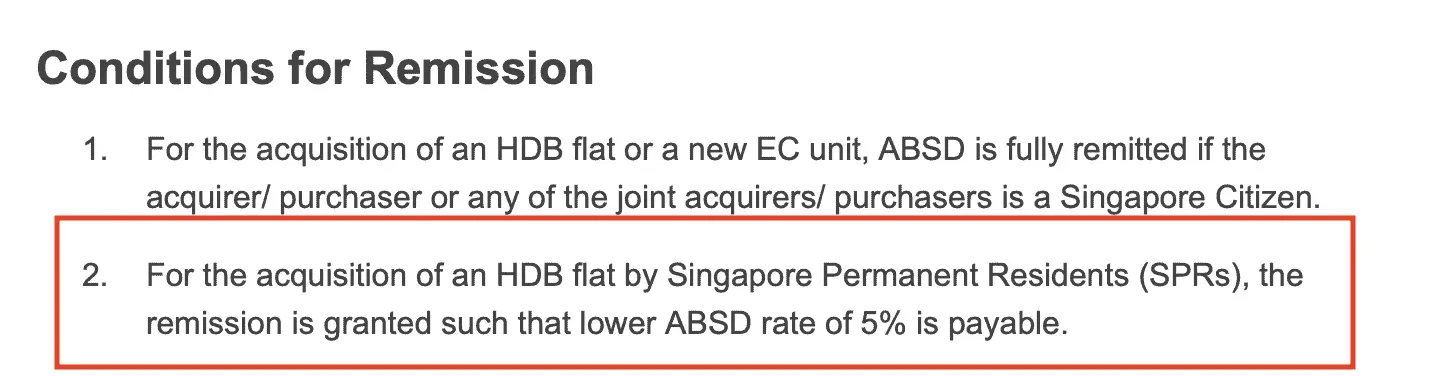

On the other hand, they will have to pay 5% ABSD (the higher of the Singaporean vs PR) if the purchaser buys a

(1) Resale EC (once it reaches the 5 year mark)

(2) Private Property

PR and PR buying HDB flats or Private Condos

In the first place, a PR couple (married or otherwise) will not be able to buy new HDB flat. And they have to wait for 3 years of being a SPR to even buy a resale HDB flat. And hence they buy a HDB resale flat as a PR couple, they have to pay 5% ABSD.

Hence they WILL pay ABSD when they buy

(1) Resale HDB flat

(2) Resale Executive Condo (once it reaches the 5 year mark)

(3) Private Property

This chart is very useful :

Don’t be sad okay….

Hopefully this helps to summarise all the cases where you need to check if a PR needs to pay ABSD !

Member discussion