HDB Option Money and HDB Negative Sales

When a HDB owner sells his HDB flat, he first issues an option to purchase (OTP) to the buyer. This is a standard document that must be issued for the seller to facilitate the HDB resale process.

What is HDB Option Money

In exchange for the OTP and the 21 days (standard in all HDB sales), an option money is given to the seller. In Singapore real estate practice, it is usually $1,000.

After 21 days, when the buyer is convinced he wants to buy the property and hence that he would exercise the option, he would then give another (usually) $4,000.

Hence in total, the HDB seller receives $5,000 in cash from the buyer. This is called the “option money”.

Many HDB sellers, at this point, would think this money is part of the selling price of the HDB flat (that’s true) and hence theirs to spend (not true).

What is HDB Negative Sale

The issue is in the case of a HDB negative sale. A HDB negative sale happens when the selling price of the HDB flat is less than the sum of CPF refund (which includes the principal amount and the famous CPF accrued interest) and the outstanding loan.

(Note: To calculate how CPF are refunded from sales proceeds of a negative sale, please read this article here).

A Simple Example of a HDB Negative Sale

Say the selling price of a HDB four room flat in Sengkang is $450,000. The existing loan (HDB or Private Bank Loan) is $400,000. The owners have used their CPF to pay for the downpayment and the monthly instalment of the HDB flat. When they checked their CPF statements, they found that the CPF to be refunded back (after the sale) is $80,000.

In this case, it is a negative sale. The selling price ($450,000) is less than the sum of CPF refund ($80,000) and outstanding loan ($400,000). To be exact, it is $30,000 “loss”. In this article, we will not go into the “worries of a negative HDB sale”. Just know that this is a negative sale.

So what happen to the HDB Option Money in a HDB Negative Sale

Now the owners have already received $5,000 option money. Is this money theirs to keep in the case of a “negative sale” ?

Nope. Unfortunately not.

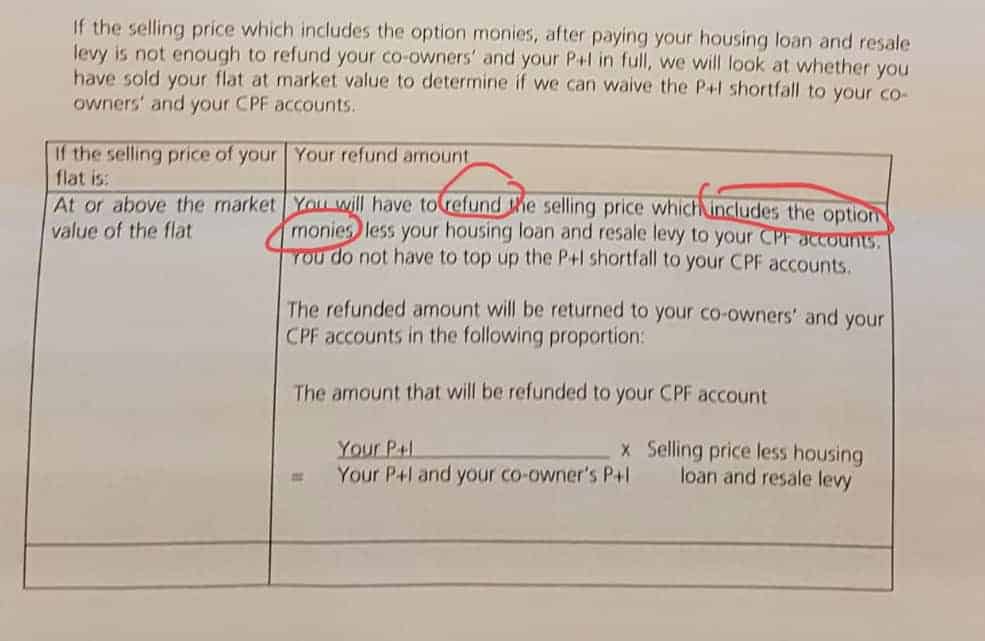

What are the CPF rules on option monies in HDB negative sales

Under CPF rules, “option monies have to be refunded to the sellers’ CPF accounts, in the case where the sales proceeds are not enough to make the full required CPF refund, before the transaction can be completed”.

This is because “any option monies (e.g. option fee and option exercise fee) received from the buyers in cash upon the sale of the property are considered as part of the selling price and need to be refunded to the sellers’ CPF accounts before the transaction can be completed”.

A letter from CPF Board was once received by my clients in a negative sale and asking specifically for them to refund the option monies.

What does this mean for you as a HDB Seller ?

This means you need to be first to be sure whether your HDB sale will be “profitable” (or more correctly, has “cash proceeds”) or your HDB sale is a “negative” one. To do so, you can do the calculations above or you can use the HDB sales proceed calculator (google for it) or get your real estate agent to do so. All competent real estate agents can very quickly let you know whether your sale is a negative sale or not.

If your sale is a negative HDB resale, you will just have to take note that you MUST NOT SPEND your $5,000 option money away. You will be asked to pay back this amount to the CPF to complete your sale. So don’t happily spend the money away or use it as the option fee for your other property’s purchase.

Or in the words of a local political joke, “option money is not your money” (in a negative sale) 😉

Note that this is different from the case where a HDB buyer simply did not exercise the option to purchase.

As more and more HDB sales are becoming negative sales with no cash proceeds and hence this little tip is important to take note of.

Member discussion