HDB option period and unexpected non exercise of OTP

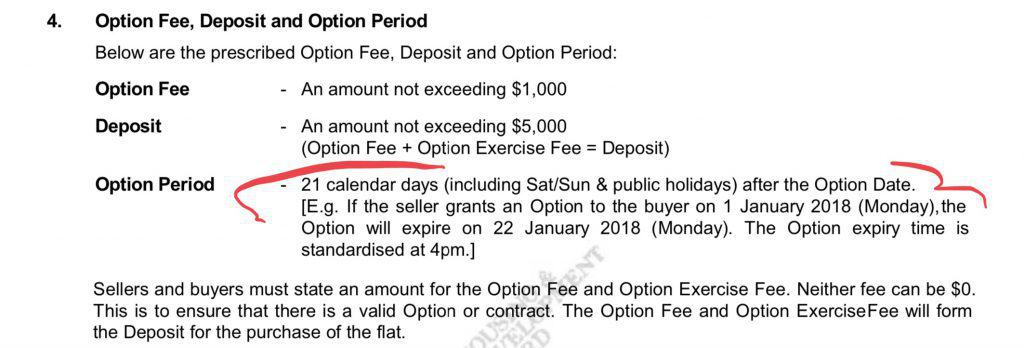

When selling a HDB flat, there is a fixed 21 days option period for the Option to Purchase. The HDB option period is 21 calendar days after the day of option issue day. This period includes weekends and public holidays.

Say, an option to purchase (OTP) for a HDB flat was issued on 1st Feb 2019. The option period of 21 days will start on 1st Feb and end at 4pm sharp on 22nd Feb 2019.

This is clearly shown in the HDB standard Option to Purchase document. All agents need to download the HDB standard option to purchase for every HDB deal.

Obligation of sellers during HDB option period

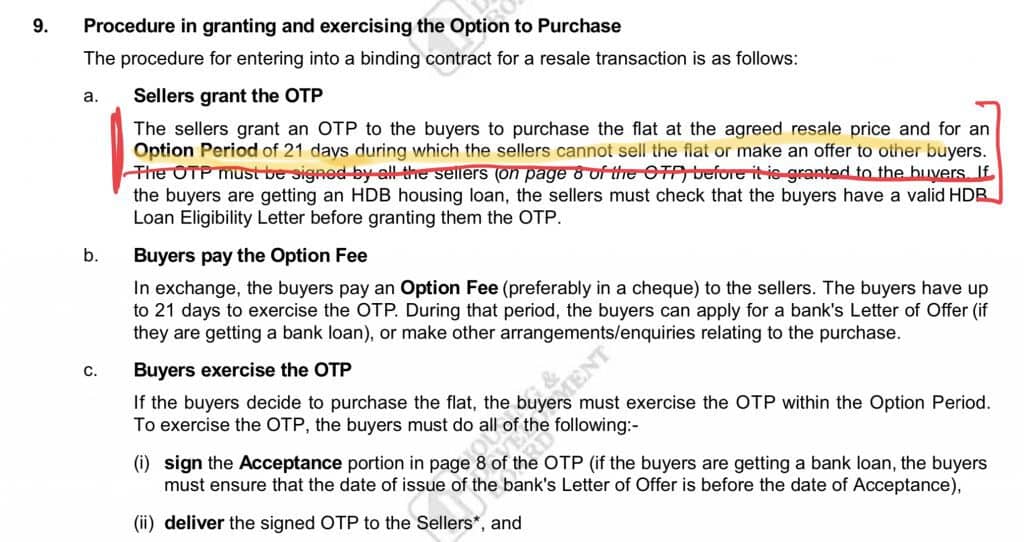

What are the obligations of a HDB seller during the 21 days option period ? This is important to know for this article because the obligation of HDB sellers affect the HDB sellers more than the buyers when the HDB buyer decided not to exercise the OTP during the 21 days option period or at the end of the option period.

When a HDB seller issues an Option to Purchase (OTP) to a HDB buyer, the HDB seller has given up his RIGHT (during the 21 days period) to sell to other buyers and also the taken up the OBLIGATION to sell the flat to the buyer if the buyer decided to exercise the OTP.

This means the sellers can no longer sell the HDB flat or issue any more option to purchase to other buyers during the whole period of 21 days. After 21 days, if the buyers did not exercise the OTP, of course, the obligation is finally removed and the sellers can go ahead and do what they want.

This is clearly stated in clause 9, page 2 of the HDB OTP document.

The key point in this rule is that the sellers cannot do anything more but wait till the OTP is exercised once they issued an OTP to the HDB buyer.

Most cases, it is fine as the owners will also be using the time to plan for their next purchase or go on their own viewings for a new property.

Obligation of the buyer during the HDB Option Period

The HDB buyer, once he gives the $1,000 option money to the HDB seller in exchange for the option to purchase, has the RIGHT but not the OBLIGATION to exercise the property.

In a crazy situation, a rich buyer can go around dishing out multiple $1,000 in exchange for multiple OTPs, and finally selecting the property he wanted and exercise the one selected OTP for $4,000.

This might sound weird, but I have seen this happening with a few buyers. In one case, she does not really want the HDB flat (close but not close enough). But then she is afraid she might not get this “good enough” property and so she “locked” down this property for $1,000 for 21 days. While she goes looking for another “more perfect” property during this 21 days. Sigh. But that is life.

When a HDB buyer did not want to exercise the OTP

So with the above rights and obligations for a buyer and a seller, what will happen when a buyer did not want to exercise the OTP during or at the end of 21 days period ?

A frustrated seller. That is what will happen.

This is because the seller cannot issue any more OTP to any interested parties during this 21 days period. Not even when it is very clear that the buyer will NOT exercise the OTP. The seller is obligated to wait till 4pm on the 21st day of the option period. In case the buyer will exercise it at 3:59pm. Because it is at 4pm on the last day that the option lapsed and his obligation is fulfilled.

Let’s say that you have issued an OTP to a buyer for your HDB flat. About 10 days after issuing the OTP (and getting the $1,000 option money), the buyer or the buyer’s agent informed you that the buyers are no longer interested in buying your property and hence will not be exercising the OTP.

The problem is that the option period is 21 days. That means, in the case above, there is another 11 days more to go before the option period is over.

So what can the sellers do about Non Exercise of Options

During these 11 days, the sellers’ housing agent can continue to place advertisements in property portals and can conduct more property viewings. The only problem is that, even if any buying parties want to buy the HDB property, the seller needs to wait till the end of 21 days option period. But then, the newly interested buyers might lose interest and not offer again at the end of option period.

Hence, it is very important, when you are a seller of a HDB flat, to be issuing the OTP to genuine buyers. While sometimes, the buyers might have some good reasons not to go ahead with the purchase (eg failure to get a bank loan for the purchase), in most cases, it is prudent to make sure you have good sincere buyers who will complete the transaction. In this case, the ability and the natural experience of your housing agent are important. So this is where your good housing agent comes in to help you.

Because good agents have tons of experience meeting buyers, they have some “feel” of the buyer and their intentions. In addition, even when they met with this unfortunate situation, the agents can calmly carry on the sales process to help you sell the property as they are experienced with these situations. They do happen sometimes. And good agents do meet them before.

Financial impact of non exercise of HDB option

When a buyer did not exercise the HDB option, the $1,000 option fee is no longer recoverable from the seller. In Singapore’s slang, the option fee is “eaten up” 🙂 .

The seller is entitled to the $1,000 option fee as that is the “price” for him giving up the right to sell to others and taking up the obligation to sell to the buyer. This $1,000 is not needed to be refunded back to CPF even if it is a negative sale later. That would be a separate deal later. As far as this deal is concerned, the $1,000 is the cost to the buyer for not exercising.

Depending on the exclusive agreement with the housing agent, the sellers will also be sharing the $1,000 with the housing agent too. It is usually a 50-50 sharing.

In my personal opinion, the 21 days option period for HDB sale is too long and should be the same as private properties’ option period of 14 days. This will reduce the impact to the sellers in these cases. For just $1,000, the wait time of 21 days is simply too long.

Have you met a case of a HDB buyer not going ahead with the exercise of the OTP ?

Share it with me in the comments below.

Member discussion