Buying Singapore Property In Trust for Your Child

There is now much talk in Singapore about buying Singapore property in trust for your child (or even all of your children !). This could be due to a very interesting Bloomberg article on how parents in Singapore are buying property under trust for their children. The title of the article was pretty sensational (Singapore’s Rich Kids End Up With Penthouses as Parents Skirt Taxes) but it did pointed to a growing trend in Singapore.

Why buy Singapore Property In Trust for your child

There are three reasons that I frequently give to my clients as the main reasons for this trend of buying properties in trust for children.

Reason one : As property prices kept rising in Singapore, well heeled parents (with lots of cash, and we shall see why this is important later) can afford to buy these properties for their children. They know that through ups and downs, the property prices in Singapore are in a long term uptrend. Hence, they want to give their children a head start by buying the properties now.

Reason two : Some parents want to avoid paying Additional Buyer Stamp Duties (ABSD) for a second property and so they bought it under the name of their children (and if the children is not of a legal age of 21 years old to hold property, they do so under a trust).

Reason three : In a way, buying a “new launch property under trust for your children is akin to a forced saving plan with the possibility of future capital gains or rental income. I will cover this in some detail in this blog post.

Singapore Property and Additional Buyer Stamp Duties

In Singapore, the purchase of a property entails the payment of a Buyer Stamp Duty. This is about 3% to 4% of the purchase price of a property. You cannot avoid this. At all.

In addition, depending on your residence status, you are also supposed to pay for additional buyer stamp duties (or lovely known as ABSD). ABSD strikes fear into many hearts of buyers due to the high tax rates.

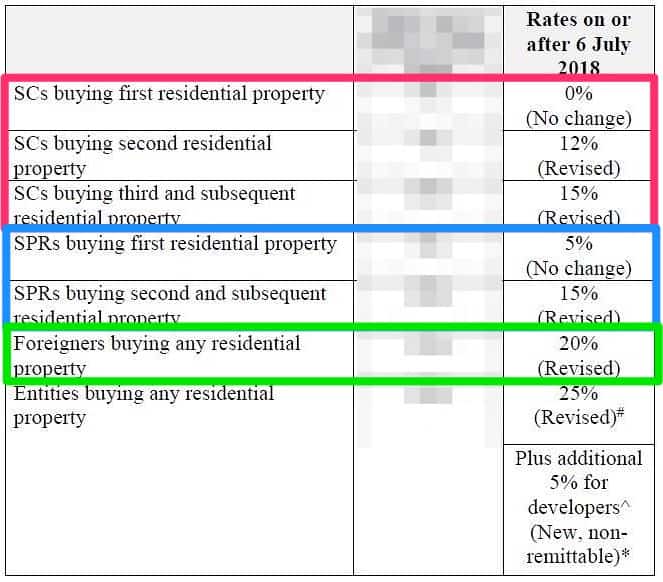

What are the ABSD Rates now as at July 2019 ?

This is outdated as at 2023. Read about the latest ABSD for Singapore Citizens, PRs and foreigners in 2023 here.

Here is the outdated 2019 ABSD rates. That's fine as we are explaining concepts here.

I always like to colour code the ABSD Rates as above to give it three different sets to help my clients quickly understand where they belong to.

Set one : Singapore Citizens. Singapore citizens pay 0% ABSD tax rate for their first property. They then pay a 12% ABSD tax rate for their second property and a 15% ABSD tax rate for their 3rd property onwards. This is over and above the Buyer Stamp Duty.

Set two : Singapore Permanent Residents. Neither a Singaporean citizen nor a foreigner, Singapore Permanent Residents (SPRs) pay 5% immediately for their first property and then 15% on their second and more property. This is over and above the Buyer Stamp Duty. Read about ABSD for PRs here.

Set three : Foreigners. Except for the nationals of these five countries (Iceland, Liechtenstein, Norway or Switzerland and United States of America), all other foreigners (think of citizens of China, Indonesia, Japan, United Kingdom) all pay a flat 20% immediately for their first and more properties. This is over and above the Buyer Stamp Duty. Read about Foreigners and ABSD here.

So the financial implications for buying a second property is pretty high. For a $1 million dollar property, the ABSD will cost $120,000 in cold hard cash (or CPF) for Singaporeans.

How does buying a property in trust help in a reduction in ABSD

So how does buying. a property in trust help in the reduction of ABSD ?

Firstly, when buying a property in trust for a child, the child is considered the “legal owner” for the property (and the parents, “the trustees” are just holding the property in trust for the child). The property is under the “name” of the child (it is slightly more complicated than that but we use the common traditional Singapore way of saying “the property is under the name of the child” to help parents understand this).

Secondly, we next then consider how many properties does a child has now at the time when the property is purchased under his/her “legal ownership”. Most normal children should have ZERO properties at a minor age 🙂

Hence when a parent purchase a property for the child under a trust, the “legal owner” (the child) will have one property now.

One property for a Singaporean citizen carries ZERO ABSD tax (instead of 12% under the parents’ ownership and hence a “saving” of 12% ABSD tax !).

One property for a Singapore Permanent Resident “legal owner” carries 5% ABSD tax (instead of 15% for a second property under the parents’ ownership, and hence a “saving” of 10% ABSD tax).

Now you can see why some parents go out of their way to get a second property in trust (under the ownership of their children) to avoid ABSD.

What are some of the pitfalls in buying a property in trust

One word. Cash. You need cash for everything.

Traditionally, when we (mere mortal adults) think of buying a property, we think of cash downpayment, then CPF payment and finally a bank loan. All in that order.

Welcome to buying a property in trust. Because the “legal owner” of the property is the child (through the trust), the child must have the “ability to pay” for the property (in legal terms). So the child must have the cash downpayment, the CPF and the bank loan.

Does a child have cash (maybe), CPF (not much except some government handouts into their CPF account but most likely the balance is very little or even zero) or even a bank loan (likely to be NO as the child does not have a job) ?

With no ability to pay for the property through CPF and with no bank loan available, that means the whole property must be 100% purchased in full cash. There are no other way of financing for this property other than paying for the whole property (and its fees such as Buyer Stamp Duty, Legal Fees etc) with Cash. Cash. Cash.

Hence you can see why I stated in Reason 1 for purchasing such a property with this method as something that well heeled parents (with cash) can afford to do. For these parents, avoiding ABSD might not be the real true reason (even if it is a nice benefit) as they can afford the property and its associated costs. They are more interested in giving their children a leg’s up in property investment.

However, for most parents, it is still possible to buy a Singapore property for their children if you have enough cash (and also focus specifically on buying a much smaller property such as a one bedroom or two bedroom unit). The smaller properties are easier to rent out anyway for rental and can provide a good income for the trust. Notice I used the word, “trust” and not the parents. All rental proceeds from the property purchased under a trust must go back to the trust and distributed for the “good” of the child (and not the parents). You might have come up with the cash but you are not entitled to the benefits of the purchase. Sorry 🙂

Finally, do note that the “legal owner” is the child. So the child (upon reaching a certain mature age) might have ideas different from the parents. Hopefully not but just be aware that the law recognise the owner as the child and hence his/her wishes will be paramount (e.g he might not want to rent it out but use it as his play house :p ).

In another blog post, I will cover another method of allowing parents to buy properties through a trust. This is by buying “building under construction” properties (BUC or what we commonly called new launches). I called this a forced saving plan and I will show you why this is quite workable for parents who want to help their children to buy a property.

Hope you find this blog post useful for understanding why do parents want to buy a property in trust for a child.

Member discussion